After the surge in 2024, U3O8 spot costs remained extra subdued via 2025, fluctuating in a comparatively brief vary from USD 63.17 (March 13) to USD 83.33 per pound (September 25).

Earlier this yr, the value hovered round USD 74.56, however financial and geopolitical uncertainty brought on the worth to fall to a year-to-date low of USD 63.71 in mid-March. A constructive long-term outlook in demand forecasts led to costs beginning to rise from April to the top of June, with spot U3O8 reaching a first-half excessive of USD 78.93.

After briefly falling to a second-half low of US$70.98 in mid-July, investor urge for food, provide issues and authorities assist drove the value as much as a year-to-date excessive of US$83.33 on September 25. Beginning December worth at $76.36, U3O8 appears to have discovered a ground on the $75 stage and has been buying and selling above the brink for the reason that finish of August.

U3O8 spot worth from December 5, 2024 to December 5, 2025.

Charts by Buying and selling Economics.

Regardless of modest worth progress, uranium’s long-term dynamics stay firmly intact and arguably solely enhancing over the course of the yr. That power, mixed with renewed investor urge for food, helped propel uranium shares increased all through 2025, reinforcing confidence within the sector’s long-term theme.

Uranium funding demand surges

For Joe Kelly, CEO of Uranium Markets, one of the vital interesting uranium market tendencies in 2025 was elevated investor demand, particularly for bodily uranium.

“In 2025, one of many key components was the continued buy of Sprott Bodily Uranium Belief (SPUT) (TSX:UU, OTCQX:SRUUF), which actually created a possibility for retail traders to purchase bodily uranium out there,” he advised Investing Information Community (INN).

SPUT added 7.8 million kilos, rising its uranium holdings to 74.04 million kilos as of Dec. 2, a 12% enhance from the 2024 tally. Internet asset worth elevated to USD 5.68 billion.

Mr Kelly defined that SPUT’s momentum was the results of widespread investor enthusiasm, which enabled the belief to purchase tens of millions of kilos from the spot market, which “pushed the value significantly increased”.

The dynamics prolonged past organizational means.

“Some traders purchased uranium instantly as a result of they thought it was an affordable funding,” he says.

Consequently, fiscal demand has develop into layered on high of public demand. This speculative curiosity “created demand for non-nuclear energy crops all over the world,” Kelly stated, including that “with out the keenness of the funding neighborhood, costs went up a little bit bit greater than they might have in any other case.”

SPUT’s lively accumulation has develop into a transparent market sign.

The rise within the belief’s holdings underscores how institutional traders view uranium as scarce and are tightening provide by eradicating the fabric from the general public market. As inventories decline, upward strain on costs will increase.

On the identical time, SPUT’s enhance in internet asset worth displays renewed investor confidence associated to nuclear reactor growth, vitality safety priorities, and the broader clear vitality transition.

If mine manufacturing lags and trusts proceed to purchase whereas utilities lock in long-term contracts, the market may head in direction of a structural deficit, drawing extra consideration to uranium shares and bodily autos.

Uranium time period costs spotlight market momentum

In a dialog with INN, IndependentSpeculator.com CEO Robo Tigre pointed to the power of long-term contract costs for uranium as one of the vital influential tendencies in 2025.

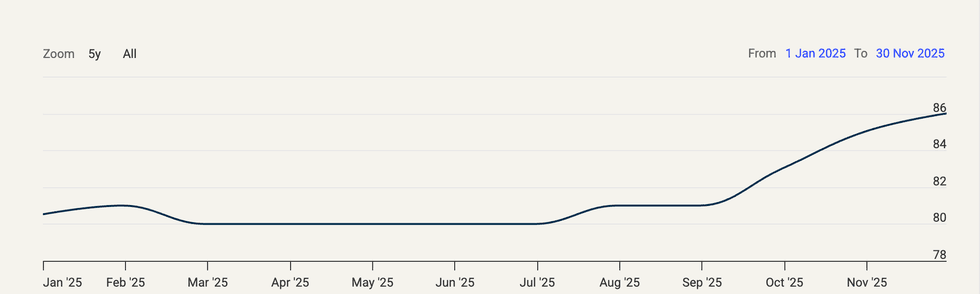

Lengthy-term contract costs, typically cited as a extra correct barometer of market exercise and sentiment, turned much less risky in 2025, beginning at 12-month intervals at US$80 and reaching US$86 on the finish of November.

Tigre emphasised that “the actual market within the uranium sector is long-term contract costs” and never the noise of each day spot costs. He stated long-term contracts would contain “precise patrons, sellers, customers and suppliers” negotiating costs and deciding what it really takes to convey new kilos to market.

Nevertheless, the problem is opacity. “There isn’t any transparency… They don’t seem to be disclosing particular person contracts,” he stated. So analysts have to piece collectively tendencies from quarterly averages.

This can be a long-term contract worth from January 1, 2025 to November 30, 2025.

Chart by way of Cameco.

The underlying market continues to strengthen via 2024-2025.

As Tigre identified, long-term costs have been “rising, pausing, stabilizing, rising” to the purpose the place there may be “clearly incentive manufacturing” that even the world’s greatest producers are struggling to realize.

International uranium majors Cameco (TSX:CCO, NYSE:CCJ) and Kazatomprom “each missed the mark, however have formally moved the goalposts,” he stated, calling this a “important … bullish” sign.

In the meantime, younger aspiring producers haven’t stepped in to fill the hole.

“None of them had been in a position to say, ‘Sure, we’ll construct this or restore this,’ and ship on time,” he famous. What seemed to be a straightforward repair turned out to be “troublesome”, confirming that provides stay constrained.

On the identical time, demand momentum is barely accelerating. Tigre stated headlines about new nuclear reactor building had been showing “each week” as BRICS nations expanded aggressively and Western governments turned extra decisively pro-nuclear. In the US, he famous, “Trump has doubled down…he is a powerful proponent of nuclear energy.”

Consequently, the market turns into structurally tighter, with risky spot actions obscuring way more persistent tendencies.

“The basics are very sturdy,” Tigre stated. “I am very bullish.”

Uranium additionally capabilities as a know-how technique

A part of the uranium demand story is said to projected progress in synthetic intelligence (AI) information middle deployments, a section that has seen a 12 p.c enhance in electrical energy consumption since 2019, in accordance with the Worldwide Power Company (IEA).

Knowledge facilities presently use 415 terawatt hours (TWh), representing 1.5% of world electrical energy demand, and that quantity is predicted to develop quickly over the following 5 years.

“In our base case, international energy consumption in information facilities is projected to double, reaching roughly 945 TWh by 2030, representing slightly below 3 p.c of complete international energy consumption in 2030,” the IEA’s AI Power Demand Report states. “From 2024 to 2030, information middle energy consumption will develop by roughly 15% per yr, greater than 4 instances sooner than the full energy consumption progress of all different sectors.”

Gerardo del Actual, writer of Digest Publishing, says the momentum within the uranium sector has shifted as an sudden coalition of “tech bros” and “mining bros” reshapes the narrative round nuclear energy.

“Who would have thought?” Del Actual stated, noting that after 18 months when the uranium commerce “seemed prefer it was caught in a quagmire,” sentiment modified sharply after the market began seeing nuclear energy as a know-how story.

“The market is each elementary and psychological,” Del Actual stated, including that the psychological increase from the speedy progress of the tech sector is powerful.

Del Actual stated he was skeptical that every one proposals for AI-powered information facilities would come to fruition, however argued that even restricted advances may result in a surge in vitality demand. He stated if tech firms “ship on 35% to 50% of their commitments,” the ensuing energy necessities can be “completely staggering.”

This comes because the uranium market is already heading in direction of a deep deficit by 2026, a pattern Del Actual believes will speed up additional. He stated he relied on his contrarian instincts to jot down “larger checks than ever” to early-stage uranium firms with trusted administration groups.

“I am excited in regards to the outcomes to date,” Del Actual stated.

“I feel 2026 shall be a yr of transition the place breakouts shall be noticeable throughout the board.”

Do not forget to observe @INN_Resource for real-time updates.

Securities Disclosure: I, Georgia Williams, don’t have any direct funding curiosity in any firms talked about on this article.

Editorial Disclosure: Investing Information Community doesn’t assure the accuracy or completeness of the data reported in interviews performed. The opinions expressed in these interviews don’t mirror the opinions of Investing Information Community and don’t represent funding recommendation. We encourage readers to conduct their very own due diligence.

Affiliate Disclosure: Investing Information Community might earn commissions from qualifying purchases or actions taken via hyperlinks or ads on this web page.

From an article in your web site

Associated articles on the net