Welcome to Week 571 of The Market’s Compass U.S. Index and Sector ETF Research. As at all times, I am specializing in technical modifications within the 30 US index and sector ETFs that I observe weekly and sometimes publish each three weeks. Paid subscribers can entry previous publications via The Market’s Compass Substack Weblog.

This week, in honor of Thanksgiving, you may obtain this week’s complete examine in a not-so-veiled try to convert free subscribers into paid subscribers.

To grasp the methodology used to assemble goal US index and sector ETF particular person technical rankings, please go to MC’s technical indicators web page at: www.themarketscompass.com Then go to “us etfs”. Under is the Cliff Notes model* of the entire directions.

*Technical rating techniques are quantitative approaches that make the most of a number of technical concerns. This consists of, however will not be restricted to, developments, momentum, accumulation/distribution measures, and relative energy of particular person US 30 indexes and sector ETFs starting from 0 to 50.

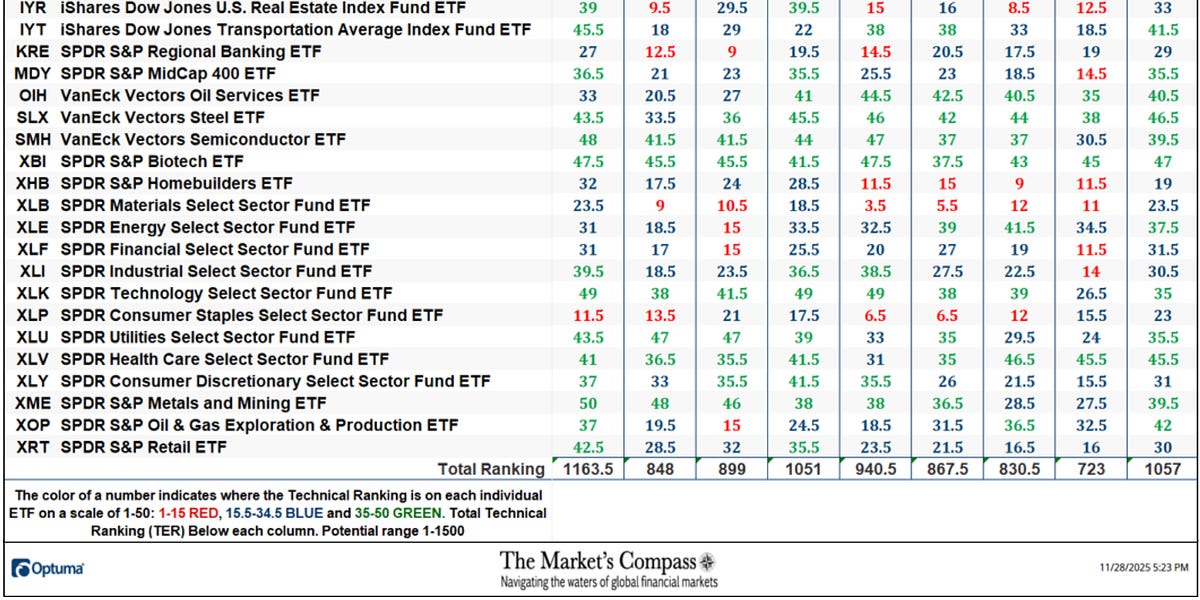

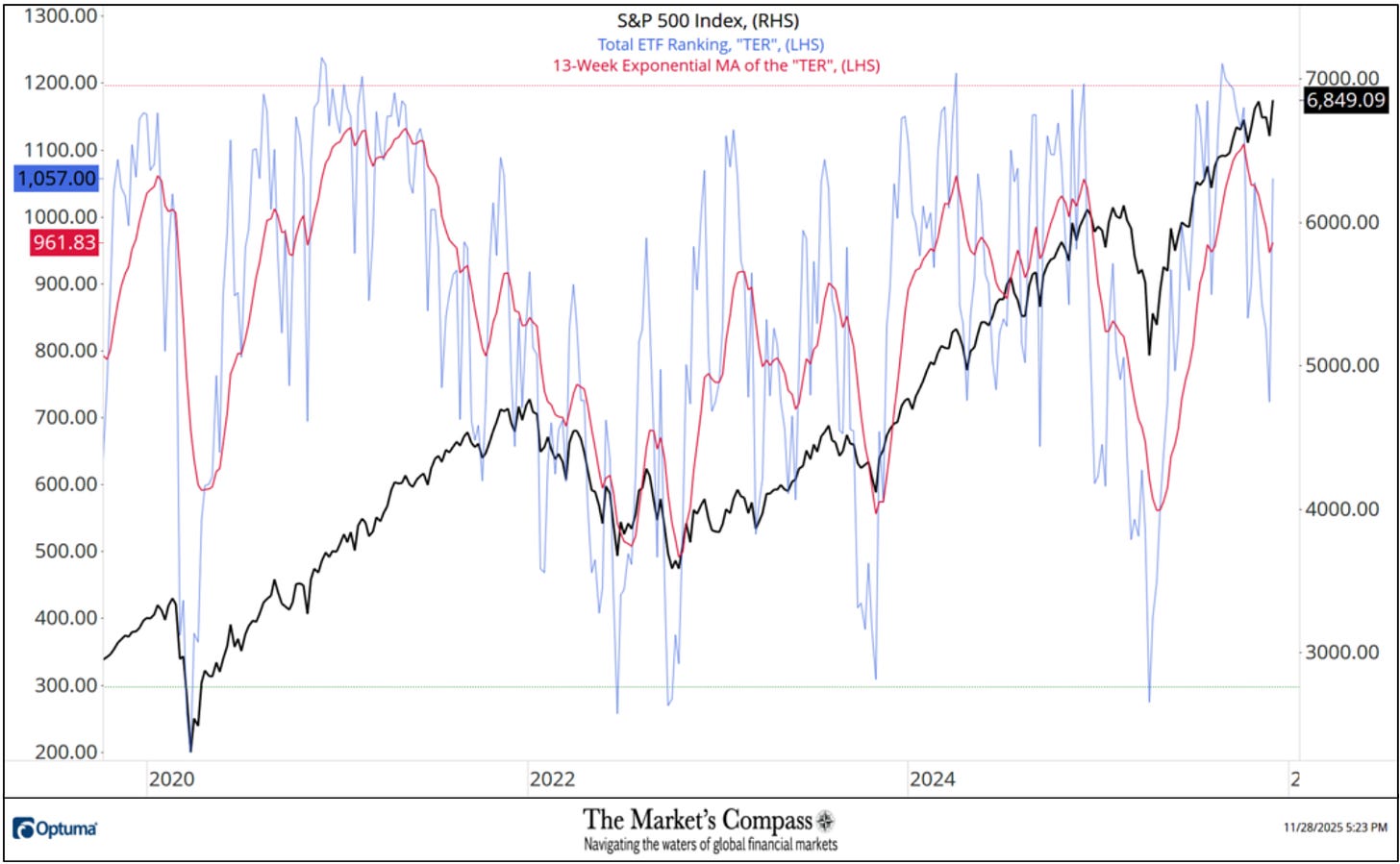

The U.S. ETF Complete Rating (“TER”) rose sharply final week, rising +46.20% from 723rd to 1057th, marking the fifth week of decline in TER.

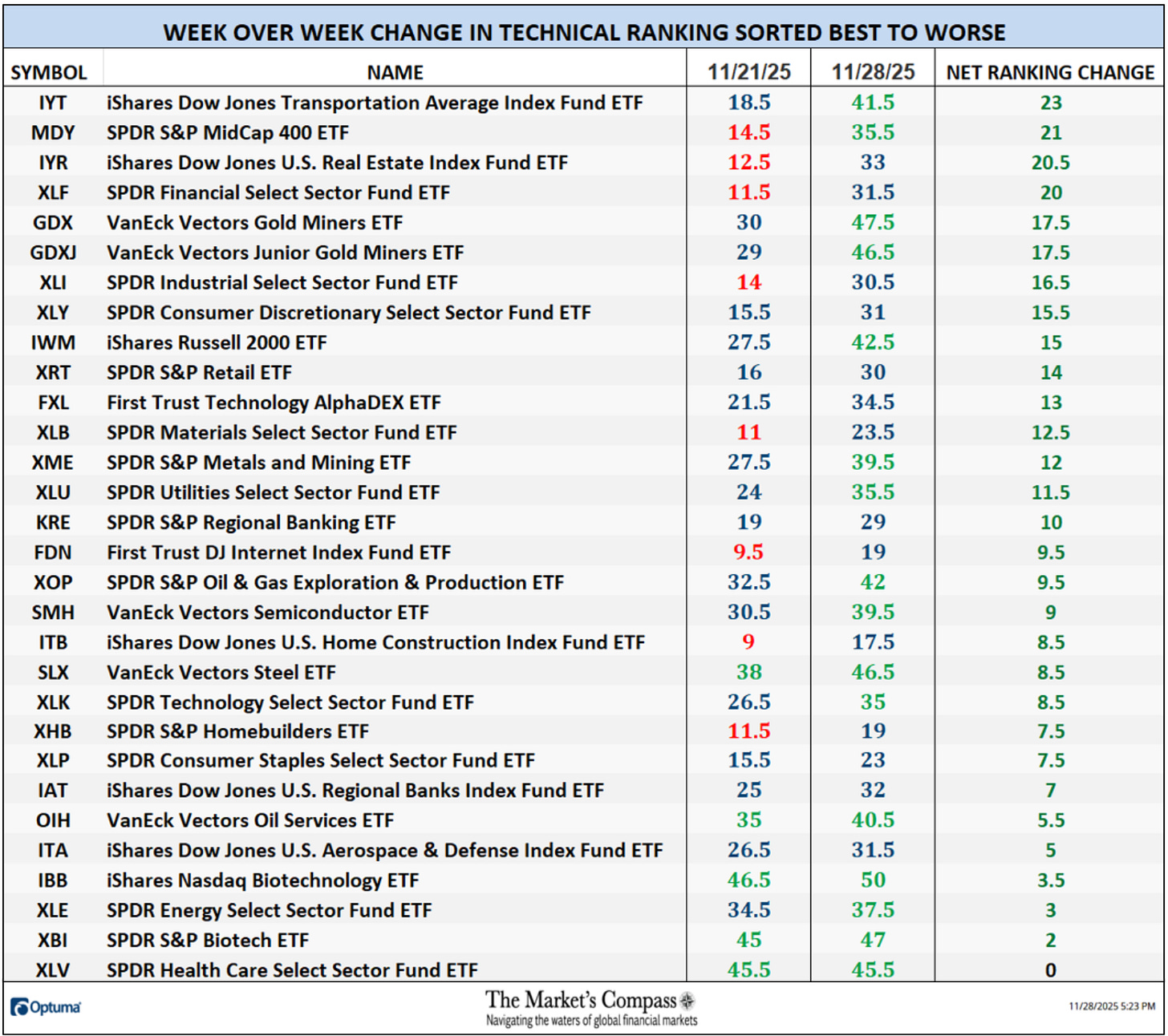

In a broad technical enchancment for 30 U.S. ETFs, 29 ETFs we observe confirmed a rise of their technical rating or “TR” and one remained unchanged. It must be famous that it was the SPDR Healthcare Choose Sector Fund ETF (XLV), which was unchanged however had a TR of simply 4.5 factors, which is close to excellent. 14 ETFs made double-digit positive factors on TR. Throughout the week, 16 ETF TRs ended within the “inexperienced zone” (TR between 35 and 50) and 14 shares ended within the “blue zone” (TR between 15.5 and 34.5). In distinction, final week there have been solely 5 shares within the “inexperienced zone”, 17 shares within the “blue zone”, and eight shares within the “pink zone” (TR between 0 and 15). Final week was the primary time in 4 weeks that we did not have a minimum of one TR within the “pink zone.” The common TR improve for the week was +11.19 (the biggest common TR improve in current reminiscence), whereas the common TR lower for the earlier week was -3.53.

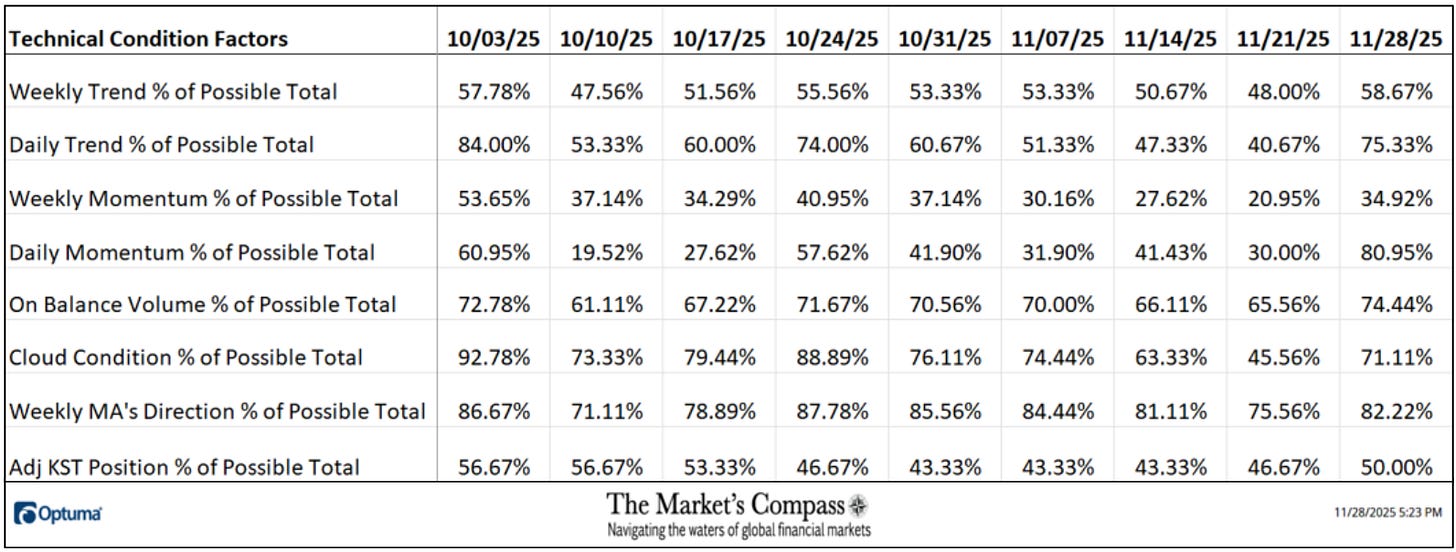

*Technical Situation Issue is derived from the calculation of the sum of the US Particular person Index and Sector ETF Technical Rankings. Proven within the Excel panel beneath is the whole TCF for all 30 TRs. When compiling the person TRs for every of the 30 ETFs, some TCFs are given extra weight than others, such because the weekly development issue and weekly momentum issue. Due to this fact, the Excel sheet beneath calculates weekly measurements for every issue as a proportion of the attainable complete.

To completely perceive the construction of the Technical Situation Issue, please go to MC’s Technical Indicators web page. www.themarketscompass.com Then go to “us etfs”.

One technical level is that excessive will increase within the DMC issue or DMCTF, for instance, between 85% and 100%, counsel short-term overbought situations. Conversely, readings within the 0% to fifteen% vary counsel an oversold situation is creating. Final week, DMCTF recorded a studying of 80.95% and 170 out of a complete of 210 constructive factors. This is a rise from 30.00% the earlier week.

As a affirmation software, if all 8 TCFs enhance week over week, extra of the 30 ETFs are enhancing internally on a technical foundation, confirming that the general market is shifting greater (suppose up/down calculations). Conversely, if all eight TCFs decline through the week, we’d verify a market-wide decline. All eight TCFs rose final week, confirming a broad-based rally within the S&P 500 Index.

The Whole US ETF Technical Rating (“TER”) indicator is the sum of all 30 ETF rankings and could be seen as a affirmation/divergence indicator in addition to an overbought indicator.

The S&P 500 rose 3.73% final week, setting a brand new weekly closing excessive, avoiding a low and persevering with a string of weekly closing lows and highs for the reason that April low. The Whole U.S. ETF Technical Rating (“TER”) rose considerably to a brand new excessive, ending the week at 1,057, confirming final week’s positive factors within the large-cap index.

Weekly Common Technical Rating (“ATR”) is the common technical rating of the 30 U.S. index and sector ETFs we observe. Just like TER, that is each a affirmation/divergence and an overbought/oversold indicator.

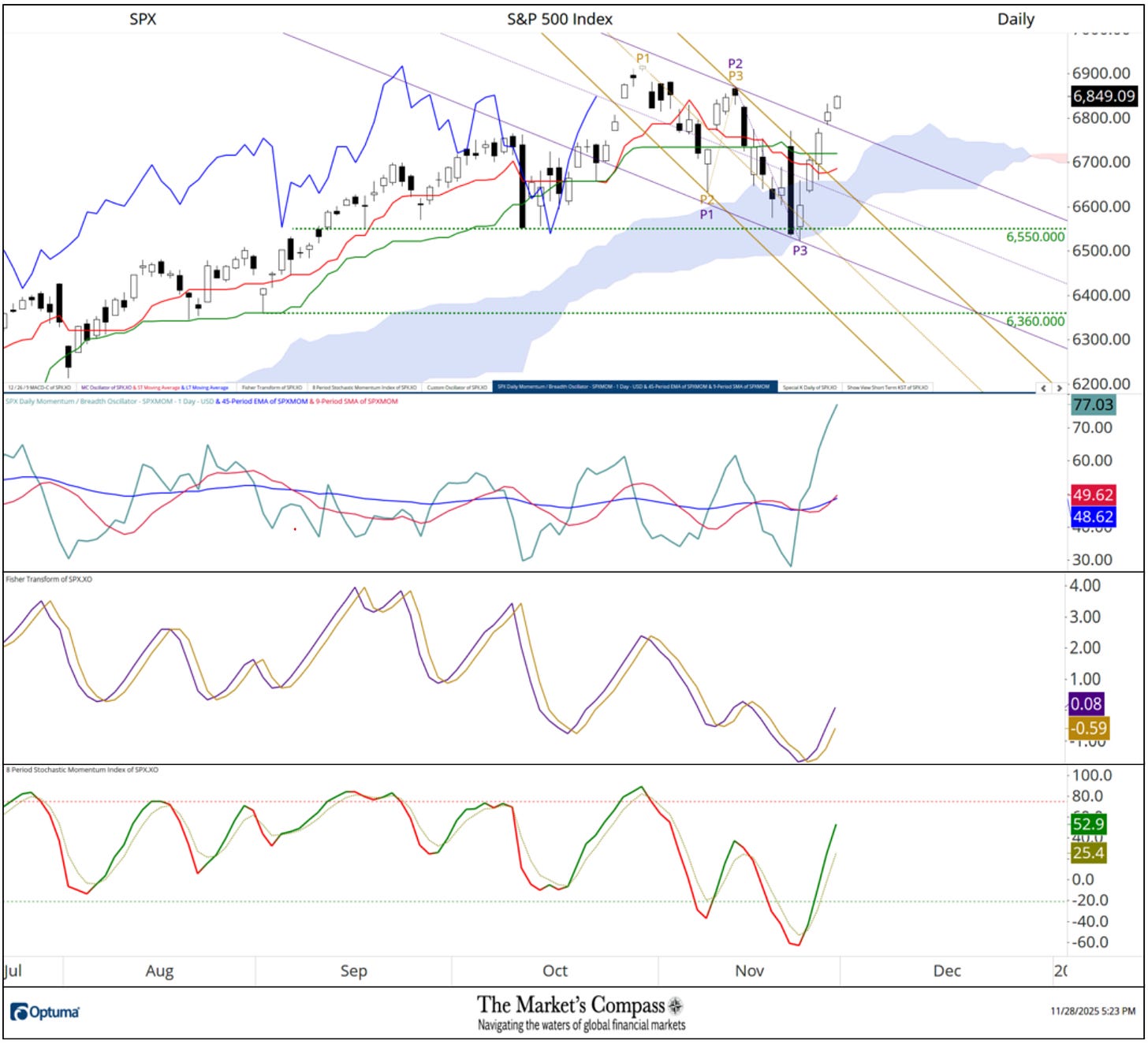

Once I final revealed my US Index and Sector ETF Survey for the week ending November seventh on November tenth, SPX was retreating on the midline (pink dotted line) of the usual pitchfork* (pink P1-P3). Two weeks in the past, the index fell, closing beneath the pink line that had been swinging costs on a weekly closing foundation for the reason that starting of Might, however by the tip of the week, the decrease parallel line (stable line) had continued to say no, and final week the SPX rebounded impulsively, suggesting that the short-term correction from its intra-week excessive of 6,910 has come to an finish. Just like the Whole Technical Rating, ‘ATR’ rises from decrease lows to greater highs according to the 9-week SMA (pink line within the backside panel) and avoids violating the 45-week EMA (blue line). These technical options level to a problem to the median line and intraweek all-time excessive of 6,910 within the coming weeks and probably days.

*An in depth and complete lesson on pitchforks could be discovered on my web site…

www.themarketscompass.com

*Doesn’t embody dividends, if any.

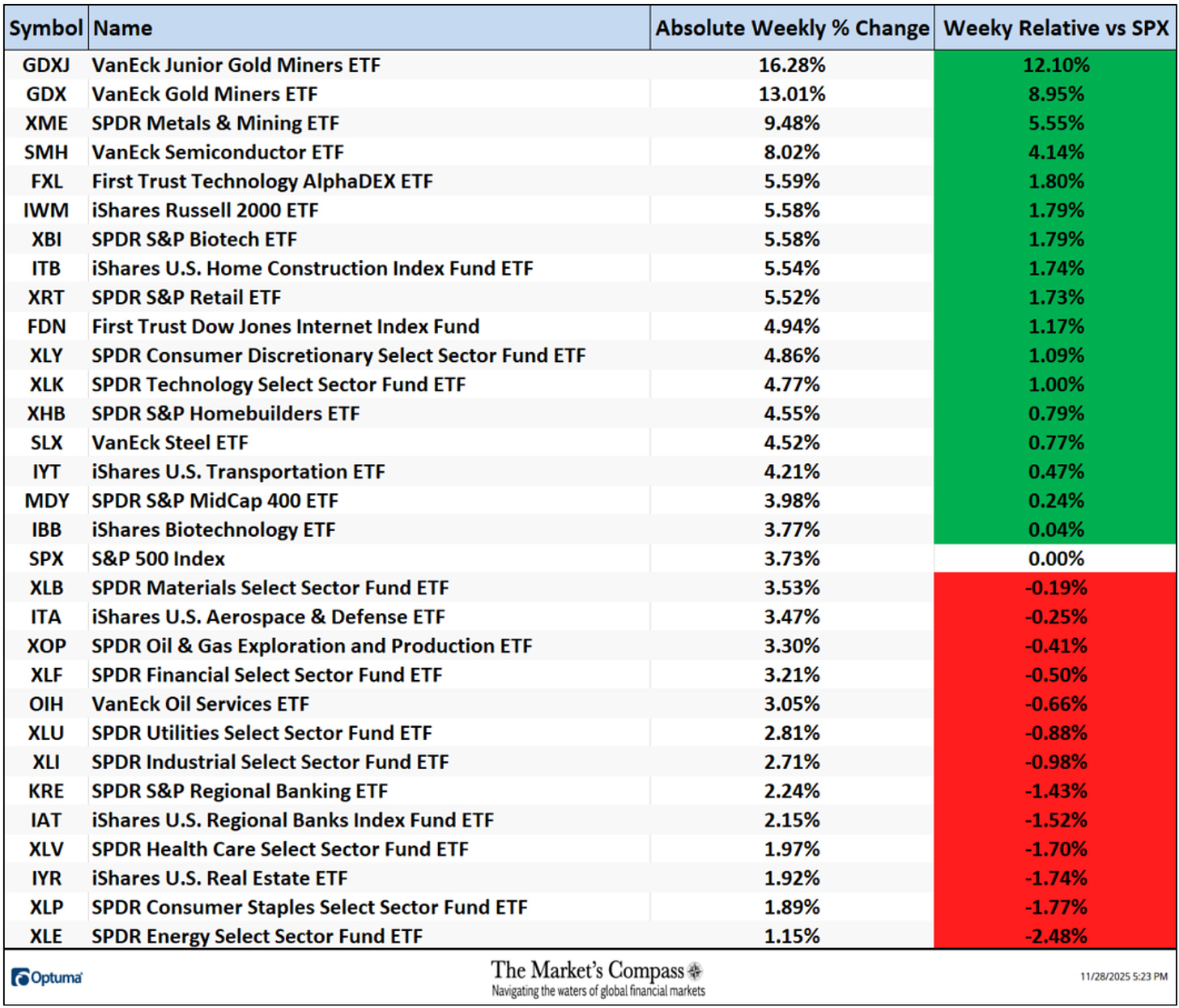

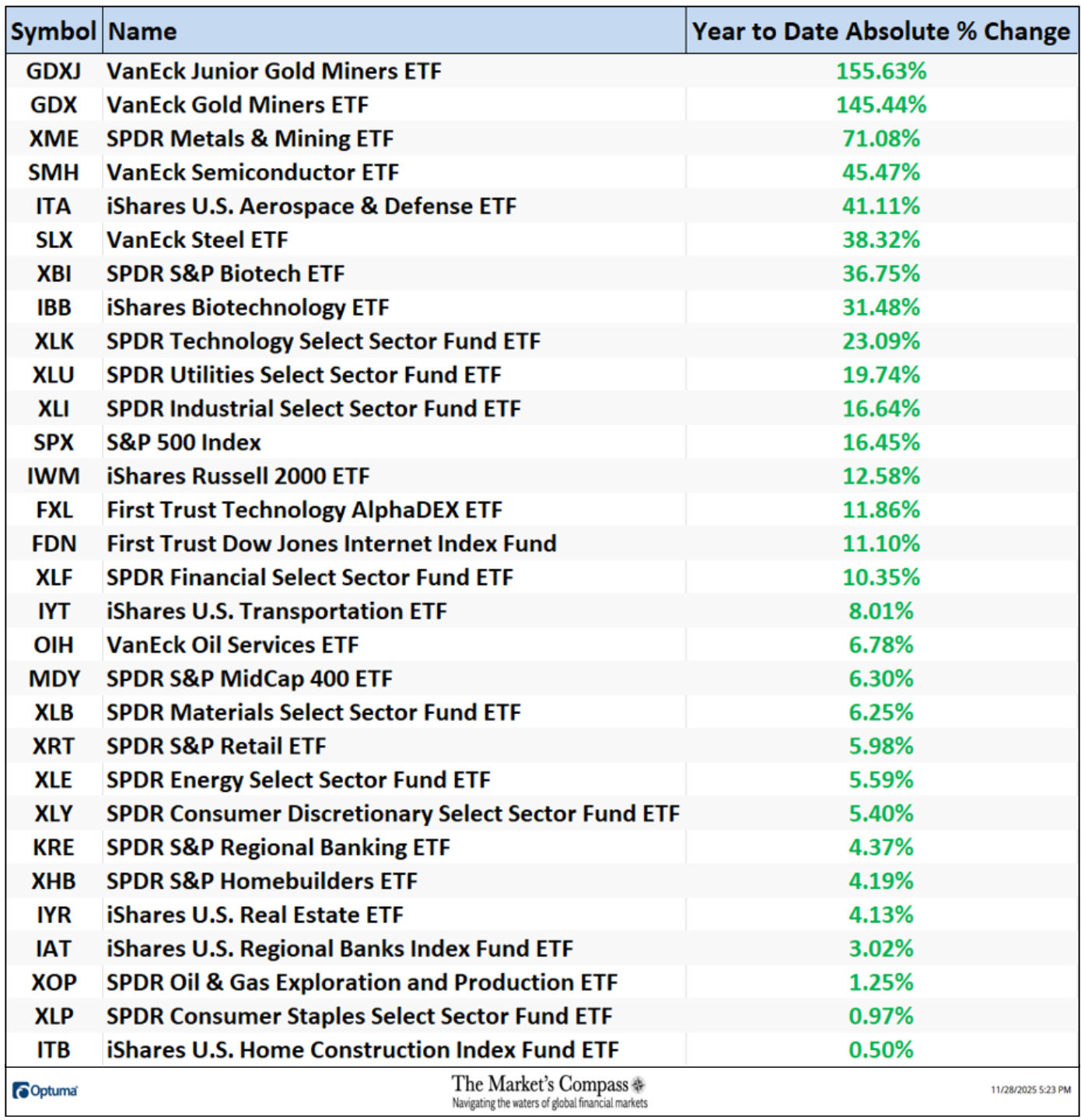

All 30 U.S. index and sector ETFs examined on this examine rose in absolute phrases on the finish of the holiday-shortened week. Seventeen ETFs outperformed the S&P 500 index’s +3.73% achieve on a relative foundation, and 13 underperformed. Final week’s notable gainers had been gold and metals and mining ETFs. Final week’s 4-day common absolute worth improve was -4.79%, whereas final week’s 5-day common absolute worth decline was -1.40%.

One week in the past final Friday, the SPX index held help on the backside of the cloud contemplating oversold alerts on all three oscillators, and on Monday the large-cap index regained floor above the cloud, main me to drag the second short-term shiff pitchfork (purple P1-P3). On Tuesday, SPX as soon as once more rallied greater, chopping via the potential resistance of the Kijun plot (inexperienced line) and Higher Parallel (stable gold line) of the semi-long-term commonplace pitchfork (golden P1-P3) pulled from the closing excessive. Final Wednesday, SPX rallied and closed above the newly drawn higher parallel line (purple stable line) of the Schiff pitchfork. Bonus rose additional on the finish of Friday’s shortened buying and selling session, coming near surpassing its all-time closing worth on Oct. 29. For five buying and selling days, my SPX Each day Momentum/Breadth Oscillator (slightly below the value panel) was in a totally (and partially) oversold situation. Whereas this means short-term overbought situations, my lead has led to a possible “retrace-and-compensation” measure testing help above the higher latitude, confirming an impulsive rise in worth. Because of this the three-wave ABC correction is probably going full for each the Fisher transformation and stochastic momentum index, with no indication of a right away draw back remaining.

12 months-to-date common absolute worth progress returned to +25.29% from +18.63% final week.

Readers who’re unfamiliar with the technical terminology and instruments talked about within the feedback on the technical standing of SPX can profit from a brief tutorial entitled “Instruments of Technical Evaluation.” Additionally, an in depth and complete lesson on Pitchfork is offered on my web site.

www.themarketscompass.com

Charts are supplied by Optuma, whose charting software program permits for technical rating calculations and again testing.

To obtain a 30-day trial of Optuma charting software program, please go to the next hyperlink:

www.optuma.com/TMC