Welcome to this week’s Market’s Compass Decardent Markets Nation (DMC) ETF Survey #560 publication. It highlights technical modifications to the 21 DM Nation ETF that I monitor each week and publish each three weeks.. There are three ETF research, together with the Market Compass Compass US Index and Sector (USIS) ETF Analysis, the Developed Market International locations (DMC) ETF Analysis, and the Rising Market International locations (EMC) ETF Analysis. Sometimes, three research are printed each three weeks and despatched to the paid Subsupack subscriber’s e mail. There are additionally weekly publications despatched to paid subscribers each Sunday. It tracks 16 technical phrases of 16 cap cryptocurrencies entitled CompaScript Candy 16 Analysis within the Market.

To rejoice the primary day of autumn, I am sending this week’s analysis to free subscribers too!

To grasp the methodology used to construct particular person know-how rankings for goal DM Nation ETFs, go to the MC Technical Indicators web page www.themarketscompass.com Choose “DM Nation ETF”. Under is the complete description Cliff Notes model*…

*The Expertise Rating System is a quantitative strategy that makes use of a number of technical concerns, together with, however not restricted to, traits, momentum, measurements and relative strengths of particular person DM nation ETFs that may be discovered within the vary of 0-50.

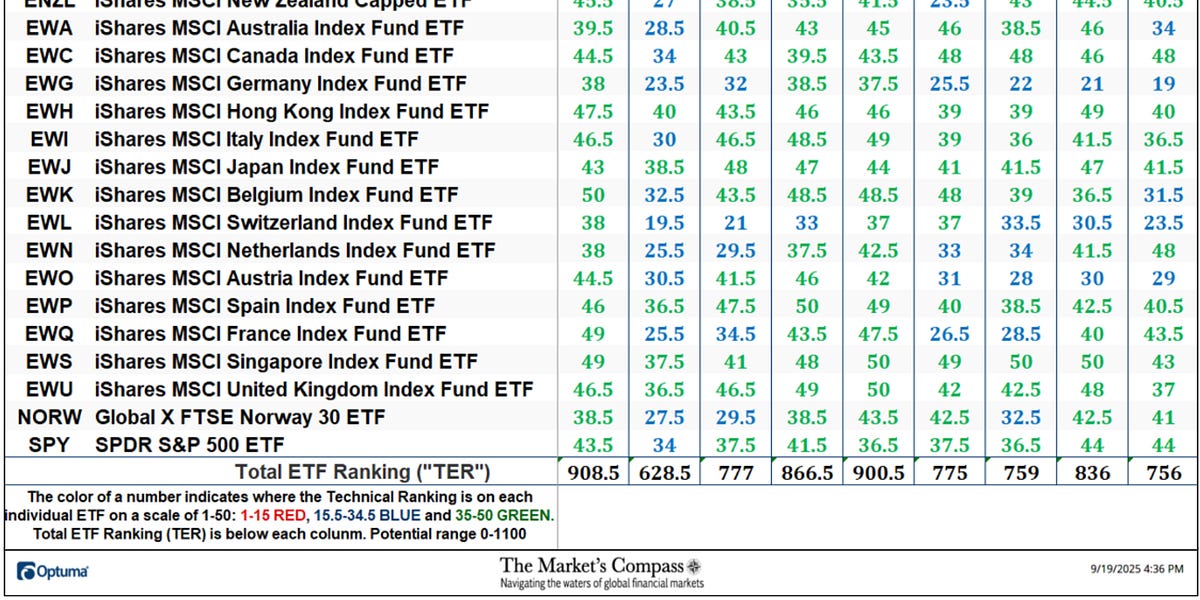

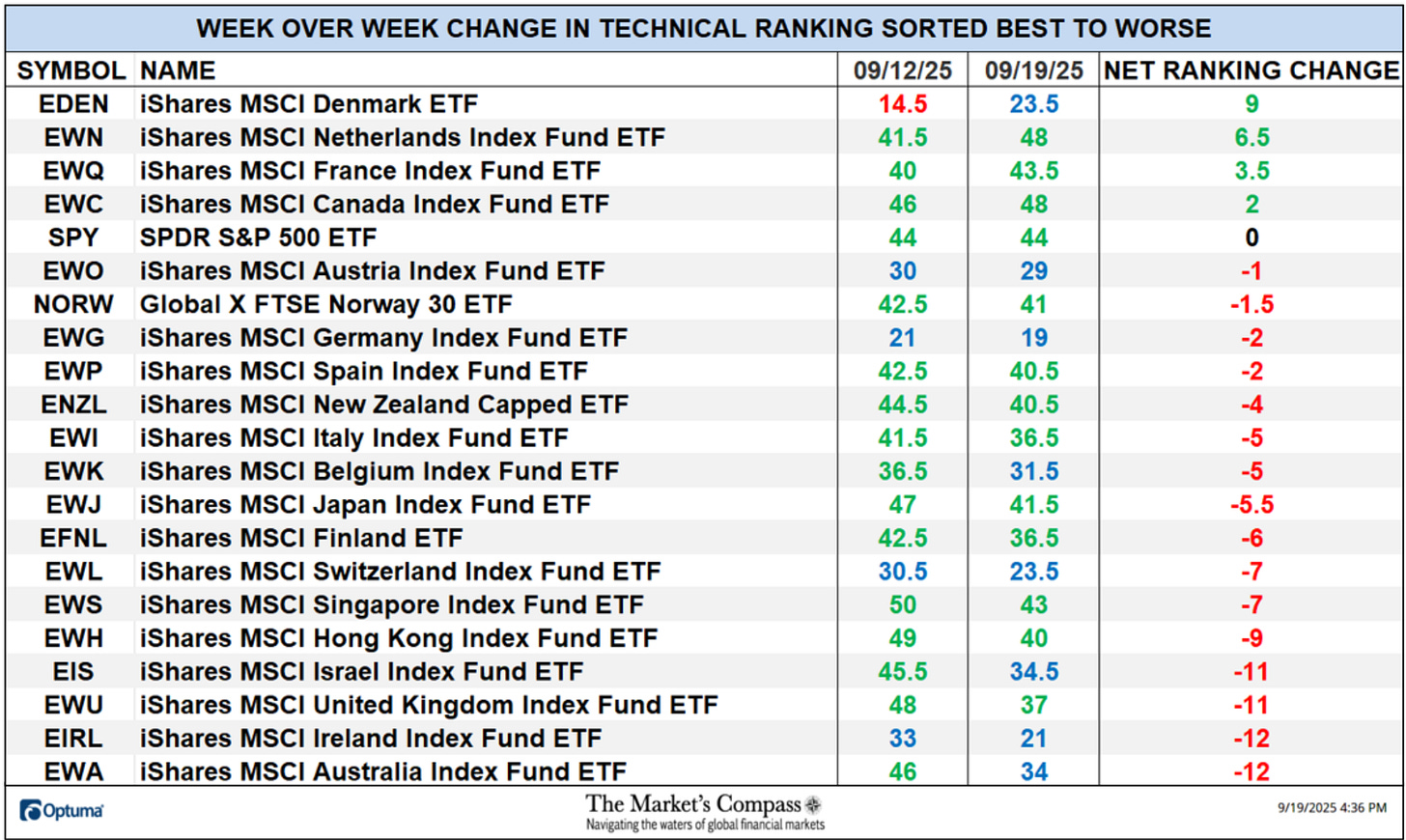

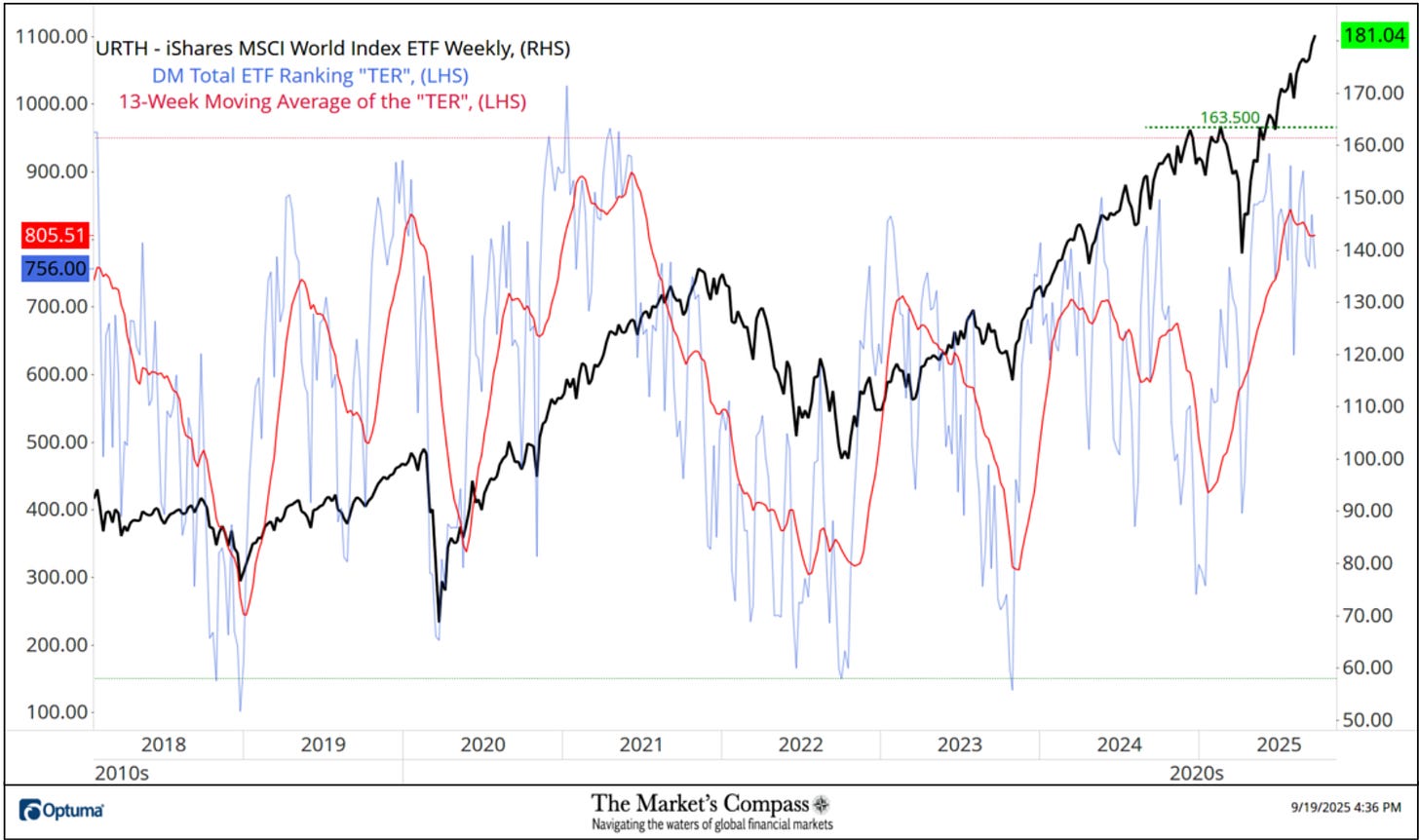

The whole technical rankings or “DMTer” in developed markets fell -9.57% from 836 to 756 final week. This was a ten.14% enhance from 759 three weeks in the past.

On the finish of final week, solely 4 ETF TRS rose, one unchanged, with 16 Fells (there have been TRSs the place 4 ETFs dropped double digits). 13 was within the “Inexperienced Zone” (35-50), and eight within the “Blue Zone” (15.5-34.5). There have been 16 TRs within the “Inexperienced Zone”, 4 within the “Blue Zone”, and one within the “Crimson Zone” (0 to fifteen). The common weekly TR loss was -2.40, and the earlier week’s common TR loss elevated to three.14.

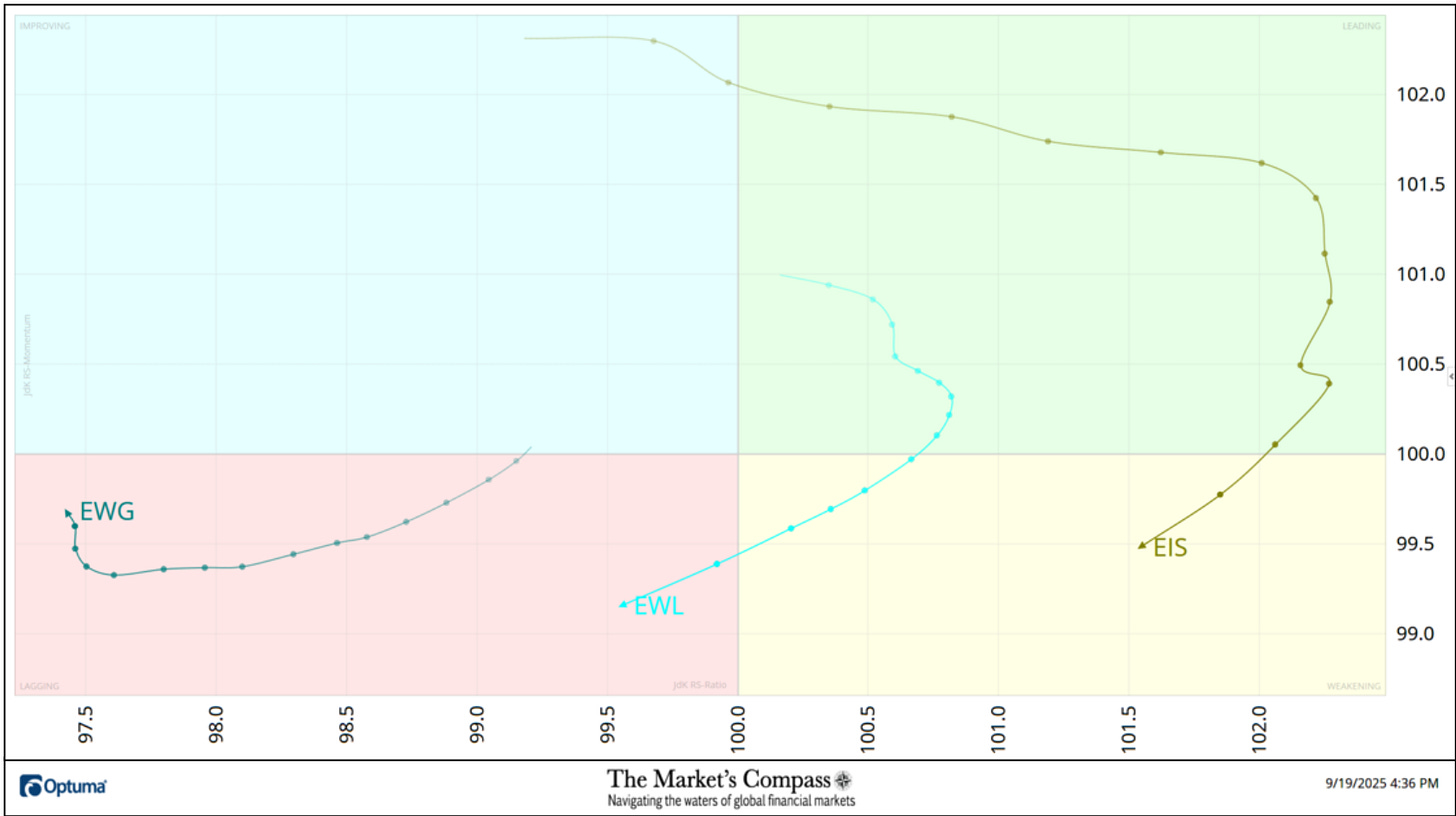

Relative rotation graphs generally known as RRGs had been developed by Julius de Kempenáe between 2004 and 2005. These charts are distinctive visualization instruments for relative depth evaluation. Chartists can use RRG to research the relative depth traits towards a typical benchmark (URTH on this case) and towards one another over a particular interval (on this case day by day) over the past three weeks. The ability of RRG is the flexibility to plot relative efficiency on a single graph and present true rotation. All RRG charts use 4 quadrants to outline 4 phases of relative traits. The Optuma RRG chart is used from studying (inexperienced) to weakening (yellow), delayed (pink), enchancment (blue), and return to studying (inexperienced). True rotations might be seen over time because the safety strikes from one quadrant to the opposite. That is only a temporary clarification of the best way to interpret an RRG chart. For extra info, see the submit script and hyperlinks on the finish of this weblog.

Not all 21 ETFs are plotted on this RRG chart. I did this with a transparent function. What I consider in is extra technical curiosity.

In my final DM ETF examine printed on September 2nd, the week ending on August twenty ninth, I referred to as consideration to the iShares MSCI Israel Index Fund ETF (EIS). The momentum started to decelerate, however nonetheless, it continued to choke optimistic relative depth till it rolled over every week in the past. The Ishares MSCI Switzerland Fund Fund ETF (EWL) fell from final week’s quadrant, falling from the primary quadrant, falling from final week’s quadrant, falling from the primary quadrant. The iShares MSCI German Index Fund ETF tracks sideways in quadrants that stay behind till a barely increased hook on the finish of final week, making it a standout relative lower in energy of the benchmark and benchmark.

*To grasp technical situation elements or TCF building, please go to the MC’s technical indicator web page. www.themarketscompass.com Choose “DM Nation ETF”. For individuals who criticize the radio model * defined beneath…

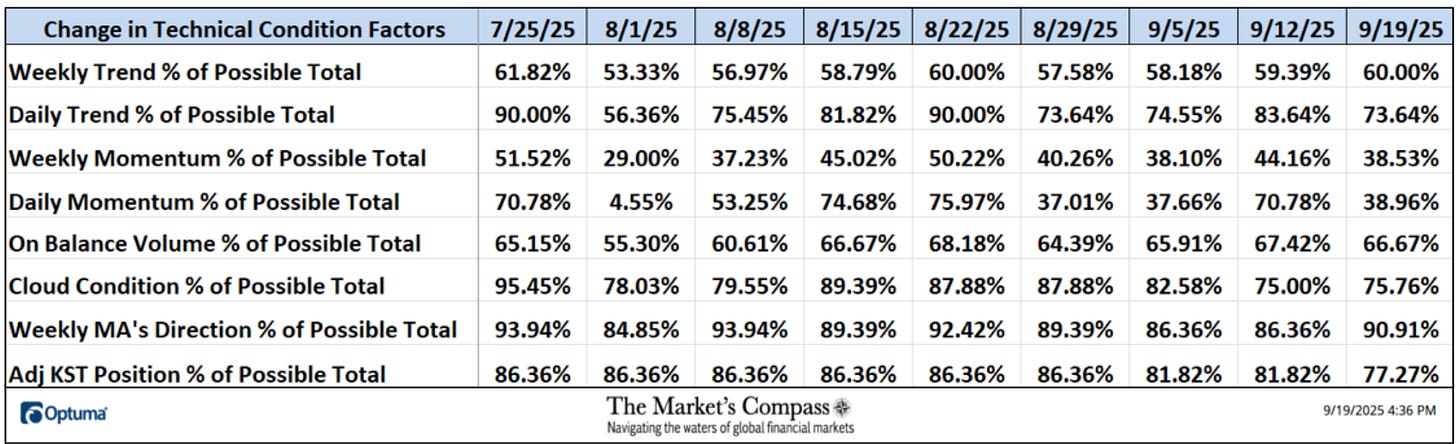

*Technical situation elements are used within the calculation of particular person DM Nation ETF know-how rankings. The Excel panel beneath exhibits the overall TCF of all 21 TRs. Some TCFs weigh greater than others, together with weekly trending and weekly momentum elements when compiling particular person TRs for every of the 21 ETFs. Moreover, the variety of TCFS inputs varies. Due to this fact, the next Excel sheet calculates weekly readings for every issue as a share of the overall that might normalize the enter. The essential clarification is that 8 TCFSs might be within the vary of 0% to 100%.

Day by day Momentum Expertise Situation Issue (“DMTCF”) fell to 38.96% final week, as 70.78% learn final week.

As a affirmation device, if all eight TCFs enhance over every week, lots of the 21 ETFs will probably be technically improved internally, leading to increased actions within the wider market (assume up advance/lower calculations). Conversely, if lots of the 21 TCFs drop over every week, lots of the ETFs are exacerbated on a know-how foundation that confirms that the broader market is shifting decrease. Three TCFs rose over every week, with 5 falling.

For an evidence of the Complete DM Expertise Rating Indicator and its technical interpretation, please see the MC Technical Indicators web page. www.themarketscompass.com.

That is merely a verify/divergent indicator, an overbought/overselling indicator.

The iShares MSCI World Indece ETF was closed at 181.04 with yet one more report weekly closure, however there’s a lack of affirmation of recent value highs by the DM Complete ETF rankings (blue line) or “TER”, leading to a barely decrease 13-week shifting common (pink line) for “Tel”. Oversold “TER” measurements (beneath 150) and nonconfirmed are normally extra dependable as they mark a right away value reversal at decrease costs than intervals of long-term over-acquisition or unconfirmed at increased costs. That stated, it stays an indicator price monitoring, and as we are able to see additional in at this time’s analysis, there are different indicator alerts which can be presently over-expanded with URTH.

The Weekly Common DM Expertise Rating (“ATR”) is the typical of the person know-how rankings of 21 developed market ETFs that I monitor. Like TER, it’s a verify/divergence or overbuy/over-over indicator.

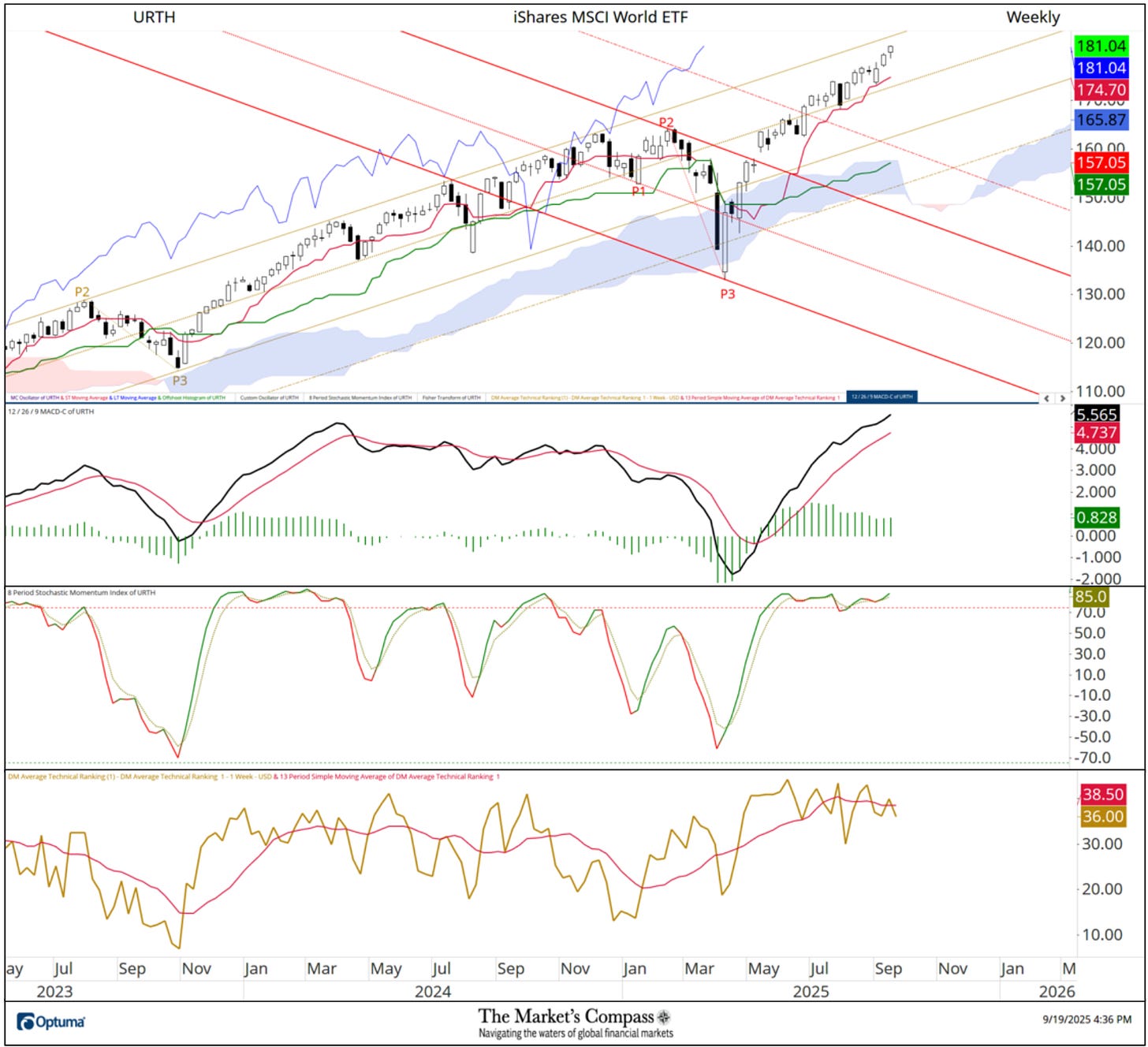

As I wrote within the final DM ETF examine, “There isn’t any sign in each MACD and the stochastic momentum index. An intrinsic discount is about to unfold at URTH” and the situations for these indicators nonetheless don’t present a sign, however DM’s common know-how rankings recommend that it’s nonetheless problematic (Backside’s indictment panel). The ATR is beneath the 13-week shifting common from one other low excessive, however value motion has changed the quadratic indicator. Worth has discovered a second assist within the Tenkan Plot (Crimson Line) and continues to rise in the usual pitch fork (Gold P1 to P3). Due to this fact, it’s silly to battle rallies and poetic value motion. The short-term technical necessities are detailed, however at first…

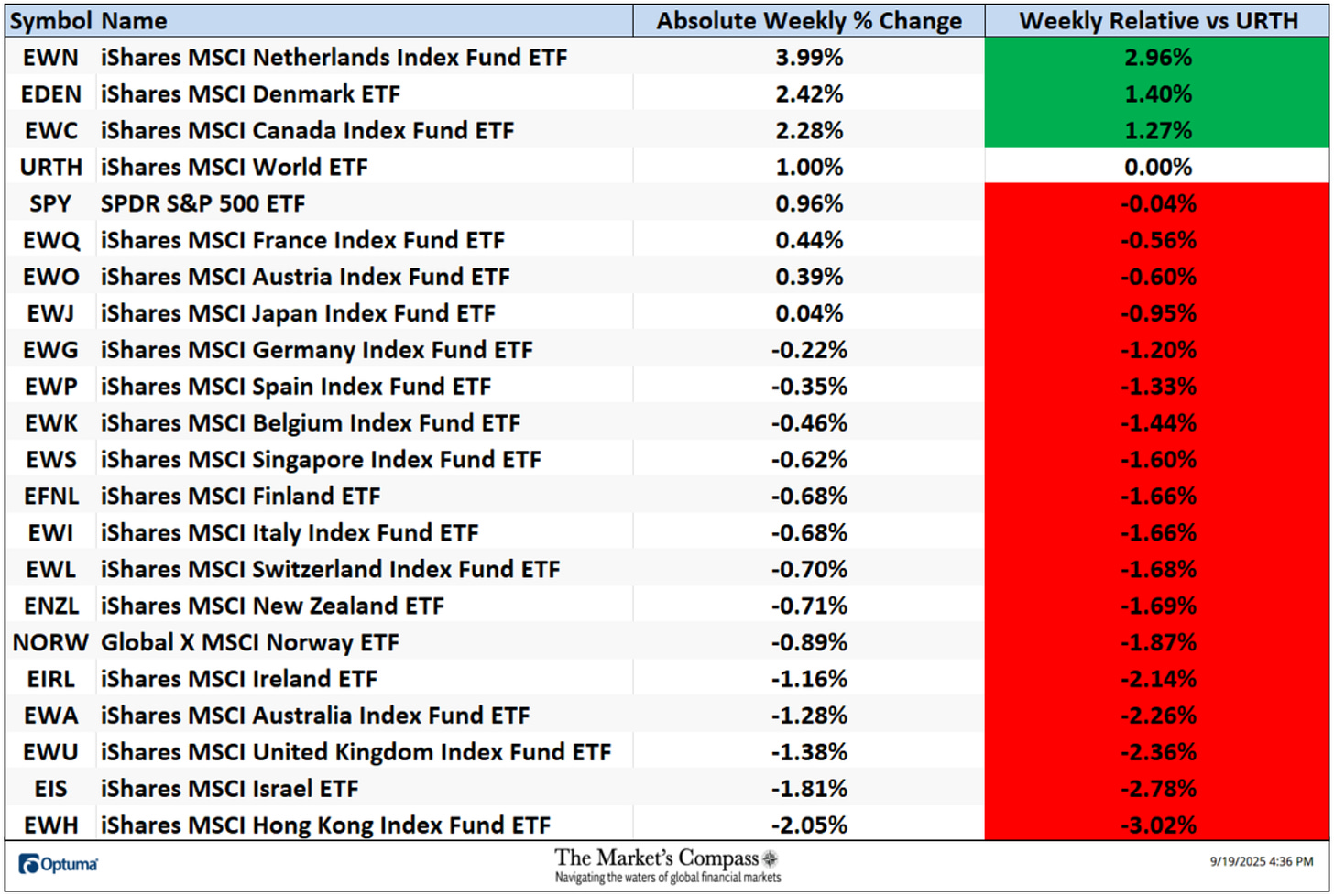

Of the 21 developed markets I tracked on these pages, seven had been completely up, with 14 not broad assist for URTH’s gatherings (over 5, over 1.00%). Solely three of the ETFs outperformed the +1.00% enhance in ISHARES World ETF or URTH final week.

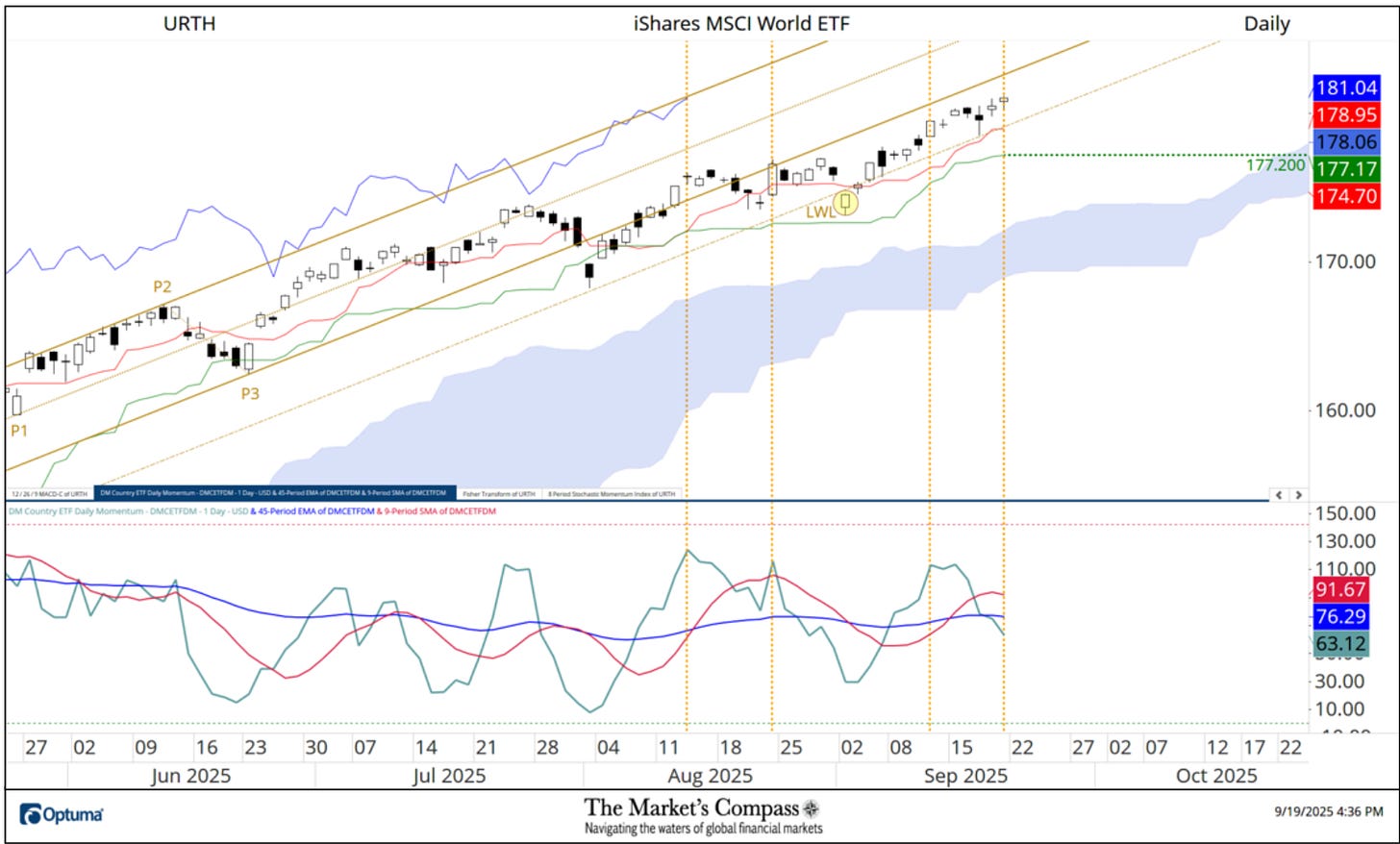

On my final printed DM Nation ETF examine day on September 2nd, URTH fell beneath the underside warning line (Gold P1-P3) highlighted in a yellow circle. It recovered again to above the decrease warning line the next Wednesday, with two subsequent exams of that assist, which in each instances retained assist, however the value couldn’t re-enter the pitchfork vary. Because the starting of the month, now we have been affected by two obstacles within the day by day momentum/width oscillator of the DM Nation ETF, confirming two new closure highs (vertical dashed strains). At present, indictor is beneath each shifting averages.

I’ve observed a number of indications that the developed market I observe doesn’t approve of the URTH transfer. Nonetheless, it stays to be seen whether or not these indicators will trigger the chickens to go dwelling and roost and produce a extra diploma of correction. value. I believe the chances recommend they accomplish that.

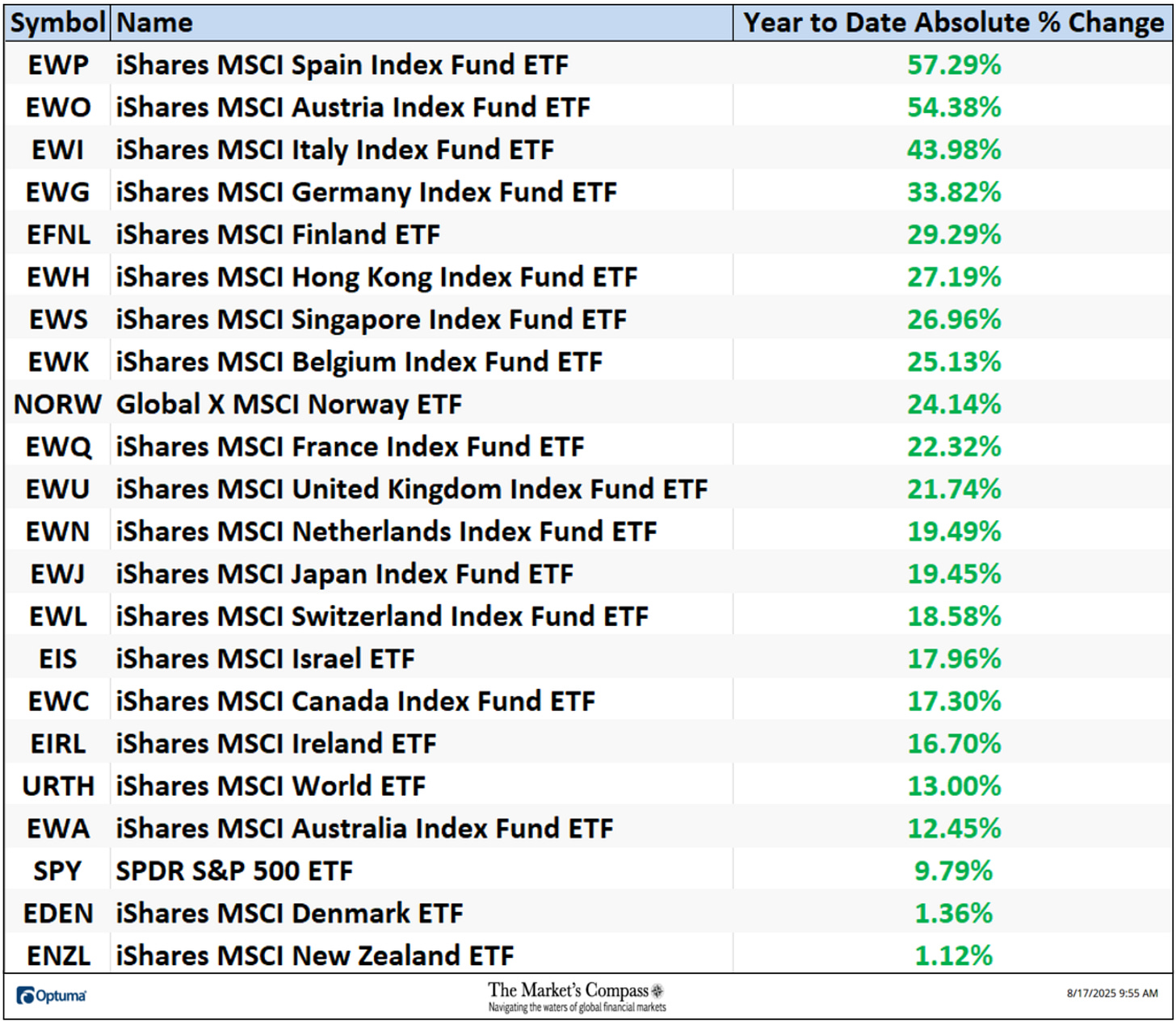

Final weekend, the value change for the typical YTD worth of 21 developed market counties ETFs was +25.48%.

The chart and value knowledge are courtesy of Optuma. Time collection knowledge together with my ETF know-how rankings might be imported, charted and backtested in Optuma.

The next hyperlinks are an introduction to the RRG chart and an in depth tutorial…

https://www.optuma.com/movies/introduction-to-rrg/

https://www.optuma.com/movies/optuma-webinar-2-rrgs/

Methods to obtain a 30-day trial of Optuma Charting software program…

www.optuma.com/tmc.