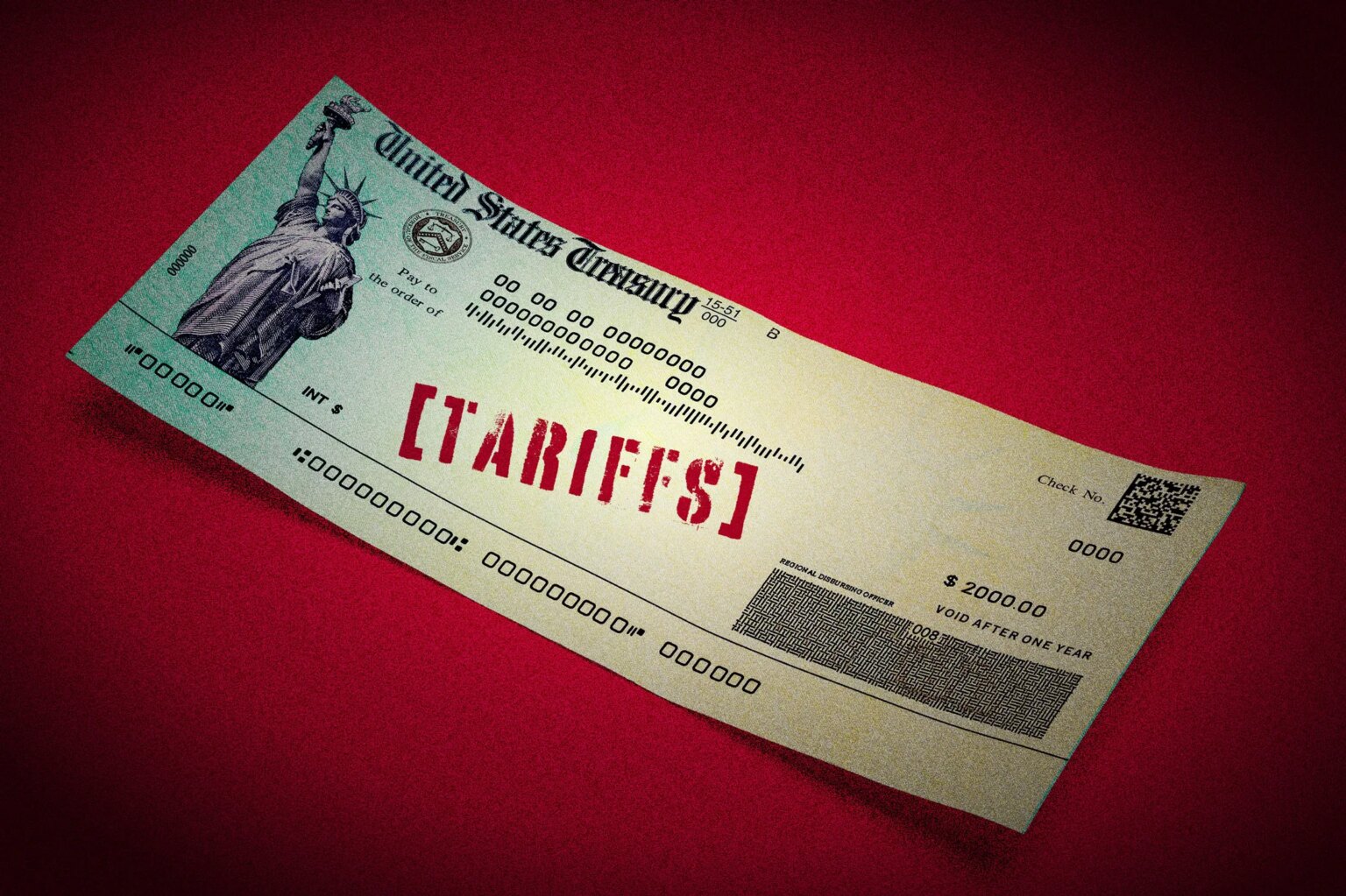

In a collection of social media posts earlier this month, President Donald Trump promised to ship $2,000 tariff checks to taxpayers beneath a sure earnings degree. This is not the primary time Individuals have heard about the opportunity of stimulus checks coming in 2025, and former proposals for direct funds did not put cash in customers’ pockets.

This time could also be no completely different.

Because the Supreme Court docket considers authorized challenges to the administration’s tariffs, President Trump appeared on Reality Social on Nov. 9 and blasted critics of his commerce coverage as “idiots.” In his publish, the president proposed a $2,000 fee to be funded with cash the federal government receives from tariffs.

“Everybody (besides high-income earners!) will obtain a dividend of at the very least $2,000 per particular person,” Trump wrote. “All the cash left over from the $2,000 fee might be used to considerably pay down the nationwide debt,” he added in one other publish.

When will customs checks be issued? Not earlier than Christmas

The president’s remarks precipitated pleasure and questions. Particularly concerning the schedule of those funds, on condition that costs are rising and lots of customers are tightening their budgets forward of the vacations. However particulars about Trump’s imaginative and prescient, which incorporates earnings cuts on tariff checks, had been initially missing.

On November 14, President Trump acknowledged that the tariff investigation wouldn’t be prepared by Christmas. “It is going to be subsequent yr,” he informed reporters on Air Power One.

Which may be the president’s plan, however there are some key obstacles to Individuals truly receiving this $2,000 dividend.

First, President Trump can not ship out tariff checks with out Congressional approval.

Gregory Daco, chief economist at EY Parthenon, informed Cash that “the gathering of duties ensuing from these tariffs is actually a group by the federal authorities, and the choice to extend spending, change or cut back spending, and lift or decrease taxes rests with Congress, not the administration.”

Mr. Daco famous how troublesome it’s for Congress to fund the federal government and cross a finances, and questioned whether or not an enormous spending invoice to ship out tariff checks would accomplish a lot.

“Except there’s a vital contraction in financial exercise, I do not assume there might be any urge for food to introduce any type of stimulus,” Daco stated.

Republicans have weak help in Congress, so President Trump might want to in some way persuade members of his personal social gathering who’re deeply involved concerning the deficit and debt. When President Trump and Tesla CEO Elon Musk issued $5,000 “DOGE dividend” checks earlier this yr, a number of outstanding members of Congress, together with Home Speaker Mike Johnson, voiced their opposition. This doesn’t bode effectively for the proposed tariff checks.

In July, Sen. Josh Hawley (R-Missouri) launched a invoice that may create a tariff rebate of at the very least $600 per particular person, however the invoice didn’t instantly achieve traction. The invoice was assigned to the Senate Finance Committee however has not been moved since.

Risk and price of customs checks

Republicans in Congress have already expressed opposition to the most recent tariff examine proposal. Sen. Rand Paul (R-Ky.) known as it a “loopy concept.” “That math would not work,” stated Rep. David Schweikert (R-Ariz.). “We need not give away any extra money,” Rep. Vern Buchanan (R-Fla.) stated, in response to a HuffPost report from the Capitol.

Economists argue that tariff revenues alone will not cowl the price of sending $2,000 to each low- and moderate-income taxpayer. The tough tariff checks proposed by Mr. Hawley may very well be extra economically sensible than the $2,000 quantity proposed by Mr. Trump.

The $2,000 checks may price about $600 billion in the event that they adopted the identical framework as coronavirus-era stimulus checks, in response to the bipartisan Committee for a Accountable Federal Price range.

Up to now in 2025, the U.S. has collected an extra $142 billion in tariffs, Daco stated.

“The annualized tariff assortment could be about $300 billion to $350 billion,” he stated. “So even in the event you had been to check the annual estimate of the checks to the annual estimate of the tariffs collected by means of 2026 on a one-to-one foundation, solely about half of that could possibly be financed.”

In different phrases, tariff checks would improve the finances deficit and nationwide debt, in the end resulting in upward stress on long-term rates of interest, he stated.

In an interview with Fox Enterprise, Prime Minister Boris Johnson acknowledged that the proposed tariff dividend “has some benefit”. However he went on to query whether or not that is the precise approach to make use of tariffs.

“If we have now trillions of {dollars} in new income, what’s the easiest way to spend it? Ought to we pay down the debt? As a result of that is going to save lots of households some huge cash in the long term and get our funds again on observe,” Johnson stated. “So there might be, as we regularly say within the Deep South, a heated alternate over what to do with this income.”

Cash particulars:

Greatest bank cards of 2025

What is going to occur to President Trump’s tariffs after Supreme Court docket oral arguments?

New invoice proposes $600 ‘tariff rebate’ stimulus checks