HIGHLIGHTS

Settlement to amass as much as 75% of the Cucho Copper Challenge (“Cucho” or the “Challenge”), Peru, through staged earn-in with an possibility to amass 100% (topic to shareholder approval).

Challenge is a large-scale, partially outcropping copper-molybdenum-silver porphyry system, with wonderful infrastructure entry solely 44 kilometres from the Pacific coast.

Cucho is complementary to Solis Minerals’ current Peruvian portfolio, offering an asset with historic drilling and really enticing untested drill targets.

Historic exploration contains 2,000 metres of diamond drilling and confirms vital copper mineralisation from floor, with each oxide and first sulphide copper.

Earlier drilling encountered vital mineralisation in all drill-holes1 with grades in step with working mines throughout the Andean copper belt:

COP14-01: 169.7 metres @ 0.24% Cu, 0.012% Mo and 1.0 g/t Ag (from floor)

COP14-02: 178.7 metres @ 0.23% Cu, 0.022% Mo and 0.9 g/t Ag (from 38.6 metres)

COP14-05: 96.7 metres @ 0.28% Cu, 0.018% Mo and 1.4 g/t Ag (from 37.2 metres)

COP14-06: 175.4 metres @ 0.28% Cu, 0.012% Mo and 1.3 g/t Ag (from floor)

COP14-07: 269.1 metres @ 0.25% Cu, 0.011% Mo and 1.1 g/t Ag (from floor)

Inc. 19.9 metres @ 0.36% Cu, 0.002% Mo and 1.0 g/t Ag (from 13.6 metres)

Inc. 18.0 metres @ 0.36% Cu, 0.020% Mo and 0.6 g/t Ag (from 138.2 metres)

Historic drilling had limitations that led to a 2014 Technical Report, ready below NI-43- 101 Requirements, concluding that “the principle geochemical and geophysical anomalies have been left with out verification by drilling”. Solis Minerals plans to drill these in early 2026.

Cucho is situated 40 kilometres from Ingredient 29 Assets’ Elida mission (Inferred Useful resource: 321Mt @ 0.32% Cu. 0.03% Mo, 2.61 gt/t Ag)2. Market capitalisation of CAD$157M3.

Challenge to be acquired by a staged, low-upfront money construction with no minimal spend.

West Leederville, Western Australia–(Newsfile Corp. – October 20, 2025) – Solis Minerals Restricted (ASX: SLM)

Chief Govt Officer, Mitch Thomas, commented:

“Cucho is a uncommon alternative to amass a large-scale, well-located, superior copper exploration mission in Peru, with demonstrated mineralisation from floor, wonderful metallurgical traits, and clear potential for a significant useful resource. What excites us is a mix of robust current knowledge – together with drilling, geophysics, and geochemistry – alongside untested anomalies that time to the potential for a mission of serious scale. Cucho suits completely into Solis Minerals’ technique of constructing a portfolio of Tier- 1 copper-gold initiatives.”

1 Seek advice from the word concerning Historic Drilling outcomes on the finish of this announcement

2 Ingredient 29 web site, August 2025 (hyperlink: https://www.e29copper.com/initiatives/elida/). Refer to notice on following web page

3 Sourced from Google Finance, 17 October 2025 (https://www.google.com/finance/quote/ECU:CVE)

Determine 1: Map of Peru and Solis Minerals’ exploration portfolio. The Firm cautions that any reference to different initiatives or mines is for illustrative functions solely. Buyers are suggested that the Cucho Copper Challenge is at an early stage of exploration and doesn’t at present have a Mineral Useful resource or Ore Reserve estimate in accordance with the JORC Code (2012 Version). Comparisons with different initiatives or mines, together with these which might be in manufacturing or at a extra superior stage of improvement, should not meant to suggest that the Firm will obtain comparable outcomes, recoveries, or financial outcomes. The potential amount and grade of any useful resource at Cucho is conceptual in nature, and there was inadequate exploration to estimate a Mineral Useful resource. It’s unsure if additional exploration will outcome within the estimation of a Mineral Useful resource. Buyers mustn’t place undue reliance on such comparisons.

To view an enhanced model of this graphic, please go to:

https://photographs.newsfilecorp.com/information/1134/271240_figure1.jpg

Determine 2: Cucho location on the subject of key infrastructure and Ingredient 29’s Elida mission amongst exploration properties held in October 2025 by different energetic worldwide mining and exploration firms together with Fortescue, Vale and Newmont.

To view an enhanced model of this graphic, please go to:

https://photographs.newsfilecorp.com/information/1134/271240_figure2.jpg

Determine 3: Photograph of Cucho Copper Challenge space and terrain. View trying south-west.

To view an enhanced model of this graphic, please go to:

https://photographs.newsfilecorp.com/information/1134/271240_figure3.jpg

Determine 4: CEO Mitch Thomas throughout a due diligence web site go to in October 2025 with Solis Minerals’ exploration workforce. The world reveals oxidised mineralisation localised alongside joints in granodiorite of the Central Zone of Cucho (Figures 7, 8). Photograph is at a web site between drill collars COP14-01 and COP14-02 (Determine 8); assay outcomes included inside this announcement. Host rocks embody diorites, metasomatized granodiorites throughout the Coastal Batholith of Peru reduce by a number of units of quartz veining.

To view an enhanced model of this graphic, please go to:

https://photographs.newsfilecorp.com/information/1134/271240_figure4.jpg

Solis Minerals Restricted (ASX: SLM) (“Solis Minerals” or the “Firm”) is happy to announce it has entered right into a binding settlement to amass as much as a 75% curiosity within the Cucho Copper Challenge (“Cucho” or the “Challenge”), situated within the Division of Ancash, Peru (Figures 1, 2) through a staged earn-in, with an possibility to amass a 100% curiosity.

1. Challenge Overview

Cucho was found by geologists from Quippu Exploraciones (a Peruvian privately held exploration firm) in 2008 within the Ancash Division of coastal Peru. Mineralisation was noticed in samples of copper oxidation inside bedrock, particles falls and distant fragments. Following a maiden drilling marketing campaign in 2014, it has been outlined as a possible large-scale porphyry copper-molybdenum system. The mission space was expanded by Quippo Exploraciones between 2021 and 2022 to replicate the massive scale of the mineralisation encountered by the acquisition of neighbouring concessions. Subsequent floor actions and re-interpretation of geophysics outlined a 3 x 1.8 kilometre mineralisation footprint.

Cucho represents a compelling exploration and improvement alternative with in depth historic datasets, current drill-defined copper mineralisation from floor, and clear geological indicators of a district-scale mineralised system.

The Firm believes Cucho has the potential to host a globally vital copper deposit and intends to advance the Challenge quickly by exploration.

2. Location

The Cucho Copper Challenge is located roughly 183 kilometres north-northwest of Lima on the Pacific coast of Peru. The Challenge lies in low-relief desert terrain, extremely beneficial for infrastructure improvement and at an elevation of roughly 1,500 metres (Determine 3). Cucho lies roughly 40 kilometres from Ingredient 29 Assets’ (TSX-V:ECU) Elida mission (inferred useful resource: 321Mt @ 0.32% Cu. 0.03% Mo, 2.61 gt/t Ag)4 (present market capitalisation of CAD$157 million at 17 October 2025) and 120 kilometres from the world-class Antamina operation. Worldwide mining firms Fortescue Metals Group (“FMG”) (ASX:FMG), Vale S.A (“Vale”) (NYSE:VALE), and Newmont Company (“Newmont”) (NYSE:NEM) are actively exploring for copper and gold within the area. FMG holds adjoining tenements 1km to the north-east of Cucho and Vale is actively exploring 4kms to the south-east of Cucho (Determine 2). Newmont has found the Illari copper-gold mission 50kms south- west of Cucho.

Floor land possession is consolidated below a single group landholder, considerably decreasing the allowing timeline for drilling. The location is accessible by current provincial roads and is strategically situated roughly 100 kilometres from the Chancay mega port, lately developed as a key export hub for mineral merchandise (Determine 2).

3. Peruvian Copper Trade

Peru is likely one of the world’s most vital mining jurisdictions, ranking5:

Third globally in copper manufacturing, behind Chile

First in Latin America for zinc, lead, and molybdenum

High 5 globally for silver, gold, and tin

Quantity 11 for gold manufacturing

Mining contributes roughly 8.5% of Peru’s GDP, and mineral exports account for practically 64% of complete exports. Copper is the main export steel, and its strategic significance is rising as a result of world power transition. In 2024, Peru produced 2.74 million metric tons of copper, securing its place because the world’s third-largest copper producer behind Chile and the DRC6.

4 Ingredient 29 web site, August 2025 (hyperlink: https://www.e29copper.com/initiatives/elida/)

5 Peru’s Mining & Metals Funding Information 2025/2026 (hyperlink: https://www.ey.com/es_pe/insights/mining-metals/mining-metals- investment-guide)

6 Mining Know-how, June 2025 (hyperlink: https://www.mining-technology.com/information/peru-anticipates-slight-increase-copper- manufacturing/?cf-view)

Peruvian porphyry programs

Porphyry copper deposits are massive, low-to medium-grade programs fashioned by magmatic-hydrothermal processes. These deposits sometimes include disseminated copper and molybdenum mineralisation, usually with silver and gold by-products. In keeping with Peru’s Geological, Mining, and Metallurgical Institute (Ingemmet), porphyry programs account for over 75% of the copper produced worldwide, with Peruvian provide consisting virtually completely of porphyry sources7.

Most financial porphyry copper operations in Peru function at grades of between 0.2% and 0.5% copper, which is in step with world averages for large-scale porphyry programs. These copper grades exclude by-products which are sometimes recovered from major sulphide mineralisation together with molybdenum, silver, gold and zinc. Whereas copper grade is vital to the viability of any operation, different traits together with circulate sheet (heap leach or concentrator), strip ratio, labour productiveness, power prices, capital depth and infrastructure additionally considerably affect the economics of a mission.

A case research for Cerro Verde has been supplied in Appendix 1. The mine initially commenced as a heap leaching and SXEW mission to supply copper cathode from modest grade oxide sources. It has subsequently transitioned to profitably mining sulphide ores with copper head grades of roughly 0.35% copper plus by-product credit of silver and molybdenum.

4. Challenge Geology

Cucho is hosted throughout the Cretaceous to Palaeocene-aged Coastal Batholith of Peru, the identical metallogenic belt as lots of the nation’s main porphyry copper programs together with a number of of the Firm’s current exploration initiatives. U/Pb and Re-Os relationship confirms Cucho’s mineralisation at ~56 Ma, coincident with the age of Peru’s largest copper deposits.

The Challenge covers a land package deal of three,600 hectares and alteration-mineralisation anomaly footprint of three x 1.8 kilometres. The anomaly is outlined by coincident copper-molybdenum geochemistry, floor mineralisation, and powerful induced polarisation (“IP”) chargeability anomalies. Mineralisation is hosted in batholithic granodiorite, with stockwork veining and copper oxide staining at floor throughout the surficial uncovered oxide zone, transitioning to major chalcopyrite-molybdenite sulphides at depth.

A separate granitic porphyry physique intersected in drilling is interpreted because the potential supply of the broader mineralising system. The geological setting, alteration assemblages, and scale of the mineralised system are straight akin to massive porphyry copper initiatives together with Hudbay’s Mason mission and Constancia operation (TSX: HBM), Teck’s Zafranal mission (NYSE: TECK), Ingredient 29’s Elida mission (TSXV: ECU) and Newmont’s Illari copper-gold mission (NYSE: NEM).

5. Exploration Historical past

5.1 Floor Sampling

Discovery of the Challenge occurred in 2008 following inspection of copper oxide occurrences. Detailed work in 2010-2011 included:

Geological mapping at a number of scales;

Stream sediment and bedrock geochemical sampling;

Petrography;

Floor magnetics and radiometrics; and

IP, magnetometry and resistivity surveys.

Later floor rock sampling confirmed widespread anomalous copper and molybdenum, outlining a mineralised footprint of three x 1.8 kilometres. Preliminary acid-leach testing carried out by the seller throughout floor oxide samples returned excessive copper recoveries, robust metallurgical traits and low deleterious ingredient content material.

5.2 Drilling

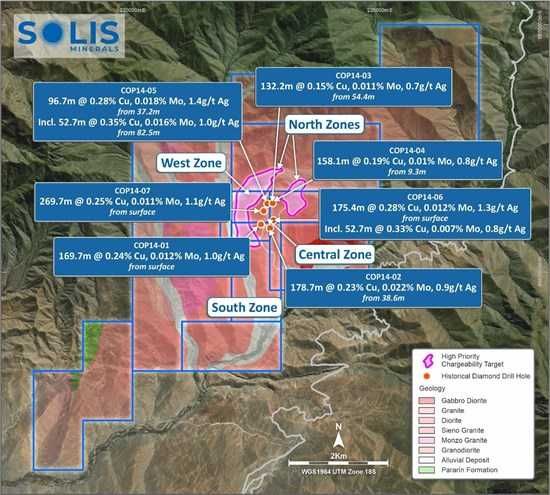

A scout diamond drilling program in 2014 comprised seven diamond drill holes for two,000 metres, designed to check near-surface oxide copper mineralisation. All drillholes intersected materials mineralisation (Desk 1, Figure7). Assays have been processed by Inspectorate Laboratory (now Bureau Veritas) in Lima and evaluated below NI 43-101 requirements. All drilling logs and laboratory reviews have been supplied to Solis Minerals. The Firm has reviewed drill core saved in Lima, Peru. Seek advice from Appendix 2 for historic drilling assays.

7 Porphyry Deposits, Undated (hyperlink: https://app.ingemmet.gob.pe/biblioteca/pdf/Econ-44.pdf)

Assays confirmed oxide and sulphide copper zones, with vital intercepts introduced in Desk 1:

Desk 1: Abstract drillhole assay knowledge from scout drilling programme. Coordinates of drill collars, course, and depth of drill holes introduced in Appendix 2.

Drilling has demonstrated a well-developed copper oxide blanket extending from floor to roughly 50-70 metres depth in most holes, transitioning into major sulphide mineralisation at better depths. This vertical zonation is clear in holes COP14-01 by COP14-05 (Determine 5 included as a reference for COP14-02), the place the very best copper grades are constantly discovered within the higher sections. For instance, COP14-01 returned 169.7m at 0.24% Cu from floor (with an oxide zone from floor to 67m), whereas COP14-05 intersected 96.7m of oxides at 0.28% Cu from 37.2m. These intervals are characterised by oxidised copper minerals akin to malachite and chrysocolla, usually related to quartz veining and limonitic fractures.

Under the oxide zone, mineralisation transitions into disseminated chalcopyrite and molybdenite hosted in quartz-sericite altered granodiorite, with sulphide-rich veinlets turning into extra prevalent. That is mirrored in deeper intercepts akin to 178.7m at 0.23% Cu and 0.022% Mo in COP14-02, and 132.2m at 0.15% Cu in COP14-03. The presence of molybdenite and elevated molybdenum grades in these intervals helps the interpretation of a mature porphyry system with a well-developed hypogene core (the central zone of major mineralisation and alteration fashioned by deep, high-temperature hydrothermal fluids).

It was famous that drill cores COP14-06 and COP14-07 deviate from this sample, returning constant grades all through their size (175.4m at 0.28% Cu and 269.1m at 0.25% Cu respectively), with out the pronounced oxide-to-sulphide transition seen in different holes. This means a extra pervasive sulphide system in these areas, doubtlessly reflecting deeper erosion or a unique structural setting throughout the stockwork zone.

Host rock alteration varies from intense propylitic alteration within the higher zones to quartz-sericite and biotite alteration at depth, in step with the central potassic and phyllic zones of a porphyry system. The mineralisation is spatially related to zones of quartz veining and brecciation, and geophysical IP anomalies point out that the system stays open to the north and northeast.

These outcomes present a compelling geological narrative for Cucho and assist continued exploration concentrating on the untested extensions of stockwork.

Limitations of the 2014 drilling programme

The 2014 drilling marketing campaign, whereas profitable in confirming the presence of serious copper mineralisation, was constrained by a number of elements that restricted its effectiveness. A 2014 Cucho Technical Report, ready below NI-43-101 requirements, concluded that “the principle geochemical and geophysical anomalies have been left with out verification by drilling” and “probably the most promising northern and northeastern elements of this stockwork marked by IP anomalies, thus far stay unverified, in addition to its central half with high-contrasting geochemical anomalies” for the next causes:

1. Restricted meterage and incomplete mineralisation delineation

The drilling programme was restricted to roughly 2,000 meters, which proved inadequate to totally delineate the mineralisation. Because of this, the marketing campaign was unable to contour the mineralised zone with confidence. The restricted variety of drill holes and their spatial distribution left massive parts of the geochemical and geophysical anomalies untested, significantly in probably the most promising northern and northeastern extensions of the stockwork, as indicated by IP anomalies.

Moreover, the absence of pre-constructed drill pads and the reliance on a single drill rig restricted the scope and suppleness of the drilling. This strategy didn’t enable for deeper or extra strategically positioned holes, and the utmost depth achieved was usually lower than 280 meters, doubtlessly lacking deeper mineralisation.

2. Impromptu drill gap placement

Drill holes have been based mostly on logistical comfort slightly than optimum geological concentrating on (Determine 8). The shortage of ready drill platforms meant that holes have been drilled the place entry was best, not the place geological proof recommended the very best potential. This strategy led to the principle geochemical and geophysical anomalies being left unverified by drilling, probably leading to an underestimation of copper content material and lacking doubtlessly higher-grade zones.

3. Unverified geochemical anomalies

A lot of the vital geochemical anomalies recognized in prior exploration phases stay untested by drilling. This was due, largely, to the gadgets listed above and a scarcity of consolidated concessions north of the traditionally drilled space. These concessions have now been added to the Challenge permitting unrestricted drilling of those anomalies (Figures 7 and eight).

6. Exploration alternative

The Cucho Copper Challenge presents a compelling case for the presence of serious mineralisation throughout the present drilled space (the Central Zone) and lengthening into undrilled anomalies throughout the North, West and South Zones (Determine 7). Whereas the present drilled space – based mostly on simply 2,000 meters of scout drilling within the Central Zone – demonstrates promising grades and mineral continuity, it represents solely 7% of the mineralisation footprint. The rest of three x 1.8-kilometre mineralised space stays undrilled, providing substantial upside.

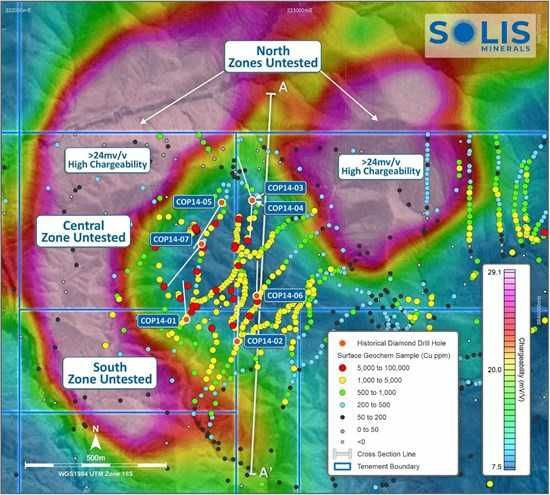

Geophysical surveys, together with magnetometry, IP chargeability and resistivity knowledge, have recognized a number of high-priority targets (Determine 7). Notably, a big chargeability anomaly to the north and northeast reinforces the interpretation of a hid porphyry copper-molybdenum system, doubtlessly the supply of the mineralisation noticed within the drilled zones (Determine 8). This anomaly stays untested by drilling, regardless of its coincidence with floor geochemical signatures and geological indicators.

Floor geochemistry additional helps the exploration mannequin, with broad zones of high-grade copper anomalies (>1% copper) that haven’t but been drill examined. These anomalies are significantly concentrated within the Central and North Zones, the place molybdenum values additionally stay steady round 0.015%, reinforcing the continuity of the mineral system. The presence of enriched copper zones beneath leached caps, as indicated by geophysical research and floor sampling, means that deeper drilling may reveal higher-grade mineralisation than at present encountered (Determine 6).

The geological setting – throughout the Coastal Batholith and that includes granodioritic and porphyritic intrusions – mirrors that of different main copper deposits.

In abstract, the undrilled anomalies at Cucho characterize a big alternative to broaden the recognized mineralisation. With sturdy geophysical and geochemical assist, beneficial geological analogues, and minimal floor constraints, focused drilling in these zones may unlock substantial copper and molybdenum mineralisation.

Determine 5: Core from historic drillhole COP14-02 displaying quartz veining, copper sulphides and stockwork inside granite porphyry. Core proven commences at a depth of 122.85 metres and ends at 125.85 metres. Related drillhole assay outcomes: 178.7 metres @ 0.23% Cu, 0.022% Mo and 0.9 g/t Ag (from 38.6 metres) (Desk 1).

To view an enhanced model of this graphic, please go to:

https://photographs.newsfilecorp.com/information/1134/271240_249580cf84b71bc6_014full.jpg

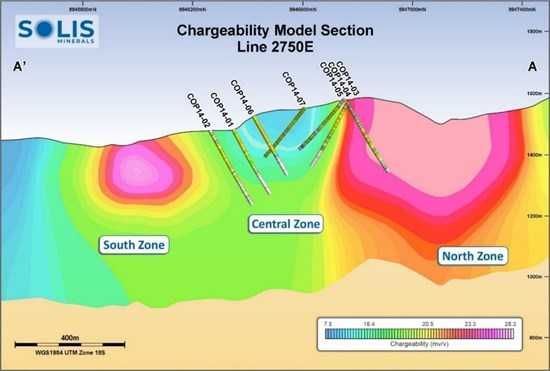

Determine 6: Cucho lengthy part with projection of drill core traces on geophysical IP chargeability anomalies. Drill gap COP14-03 hint is projected from outdoors of the anomaly depicted. Seek advice from Determine 8 for location of lengthy part.

To view an enhanced model of this graphic, please go to:

https://photographs.newsfilecorp.com/information/1134/271240_249580cf84b71bc6_015full.jpg

Determine 8 highlights a big potential porphyry system with concentric zoning of copper and molybdenum anomalies. Floor molybdenum concentrations and drill gap copper grades are highest throughout the central portion of the outlined goal space, suggesting a sturdy mineralised core. The presence of >24 mV/V induced polarization anomalies additional helps the interpretation of disseminated sulphide mineralisation at depth, making these zones prime candidates for follow-up drilling.

Cucho illustrates a traditional eroded porphyry system, with a leached cap transitioning into an oxide zone after which right into a sulphide-rich core. This mannequin aligns with noticed drill outcomes, the place most holes intersected greater copper grades within the higher sections, in step with oxide mineralisation, adopted by lower-grade sulphide zones at depth. Notably, drill holes COP14-06 (Determine 9) and COP14-07 present constant grades all through their size, indicating a extra pervasive sulphide system or deeper erosion stage in these areas.

In abstract, the combination of floor geochemistry, drill knowledge, and geophysical anomalies presents a compelling case for focused infill and step-out drilling. Future drilling ought to deal with verifying the untested extensions of the stockwork, refining the oxide-sulphide transition, and delineating the complete extent of the mineralised system to assist useful resource estimation and improvement planning.

Determine 7: Plan of Cucho exploration concessions displaying historic drilling over geology and untested geophysical IP anomalies.

To view an enhanced model of this graphic, please go to:

https://photographs.newsfilecorp.com/information/1134/271240_249580cf84b71bc6_016full.jpg

Determine 8: Plan of enormous geophysical chargeability anomalies at Cucho with drill gap traces overlaid with geochemistry pattern assays.

To view an enhanced model of this graphic, please go to:

https://photographs.newsfilecorp.com/information/1134/271240_249580cf84b71bc6_020full.jpg

6.1 Exploration goal

Cucho doubtlessly incorporates a big, porphyry-style mission, based mostly on the size of the geophysical and geochemical anomalies, geological mapping, and the restricted drilling accomplished to this point. The potential amount and grade of mineralisation are conceptual in nature at this stage, as there was inadequate exploration to estimate a Mineral Useful resource, and it’s unsure if additional exploration will outcome within the estimation of a Mineral Useful resource.

6.2 Work-to-date in assist of the exploration goal

Potential for a big, doubtlessly bulk tonnage mission is supported by:

Technical Report from 2014 accomplished to NI 43-101 requirements.

2,000 metres of diamond drilling (7 holes) within the Central Zone.

Intensive geophysical (IP, magnetics) and geochemical anomalies over a 3 x 1.8 km space.

Geological mapping and floor sampling confirming porphyry-style mineralisation.

Analogous scale and grade to main porphyry copper deposits of this age within the Americas.

6.3 Deliberate work & timeframe

The following section of exploration will embody:

Step-out and infill drilling of high-grade floor anomalies and geophysical targets.

Useful resource definition drilling within the Central, North, and West Zones.

Up to date geophysical surveys, geophysical-deposit modelling and metallurgical take a look at work.

The Firm goals to check the validity of the exploration potential of the Challenge and report a Mineral Useful resource estimate inside 12 – 18 months, topic to allowing, drilling and funding.

Determine 9: Drill core from historic gap COP14-06 displaying quartz veining, copper sulphides and stockwork. Core proven commences at a depth of 122.00 metres and ends at 125.00 metres. Related drillhole assay outcomes: 175.4 metres @ 0.28% Cu, 0.012% Mo and 1.3 g/t Ag (from floor) inc. 91.2 metres @ 0.33% Cu, 0.007% Mo and 0.8 g/t Ag (from floor) (Desk 1).

To view an enhanced model of this graphic, please go to:

https://photographs.newsfilecorp.com/information/1134/271240_figure9.jpg

7. Tenure Package deal

The Cucho Copper Challenge includes a contiguous 3,600 ha efficient space of mining concession block, overlaying the core mineralised system and areas appropriate for potential future mine infrastructure. The tenure has been secured by staged consolidation since 2008. All concessions are in good standing. Desk 2 presents the concessions that type the Cucho Copper Challenge.

Desk 2: Cucho Challenge concessions package deal

Social and group concerns have been reviewed with no hostile findings. A group assist settlement for exploration actions is in place having been lately renewed in April 2025. There are not any recognized overlaps with protected or reserved areas.

8. Infrastructure

Cucho advantages from excellent current infrastructure:

Proximity to port: 44 kilometres from the Pacific Ocean and ~100 kilometres from the Chancay mega port, a significant logistics hub at present working.

Highway entry: Linked by provincial roads with simple routes for upgrading.

Topography: Low-relief, low-rainfall desert terrain extremely conducive to mining infrastructure and cost-effective improvement.

Land entry: Neighborhood landholder that has formally expressed curiosity in mineral exploration.

Energy and water: Entry to close by hydropower era and water sources. Excessive UV publicity supplies photovoltaic / photo voltaic era optionality.

9. Alternatives

Solis Minerals considers Cucho to characterize a transformative copper exploration acquisition, with a number of value-enhancing alternatives, together with:

Mineralisation scale: Drilling to this point has solely examined a fraction of the mineralised footprint. Clear extensions to the north, northeast, south and at depth stay untested.

Fast delineation: Historic drilling has intercepted broad widths of copper mineralisation with the chance for potential early useful resource supply.

District-scale potential: Massive IP anomalies and the presence of an untested granite porphyry supply intrusion spotlight potential for a significant copper-molybdenum porphyry discovery.

Grade enhancement: Floor geochemistry identifies a number of areas of >1% copper anomalies not but drill-tested. Increased grade zones exist inside broad intersections reported that can be focused as a part of future exploration programmes.

Metallurgical optionality: Excessive leach recoveries from oxide materials assist potential heap leach improvement alongside typical sulphide flotation.

Fast development: With historic baseline knowledge and beneficial land entry, Cucho could be superior to drilling inside 6 – 9 months.

Heap leaching: The Central Zone of the Challenge (Determine 8) signifies potential for a considerable oxide copper useful resource. The mineralisation is at floor, which considerably reduces stripping necessities and enhances the economics of open-pit mining and leach pad placement. Beneficial mineralogy (chrysocolla, malachite, copper pitch) and low deleterious components (Ca, Mn, Fe, S), assist sturdy leach potential. It’s meant to analyze the chance for a standalone or hybrid leaching / SXEW circuit in parallel with the proposed preliminary drilling marketing campaign.

10. Transaction phrases

Solis Minerals has entered right into a binding settlement with Quippu Exploraciones SAC (“Q-Ex” or the “Vendor”), a non-public entity which holds a 100% curiosity and rights to all of the Cucho exploration concessions (Desk 2). Q-Ex are Peruvian skilled geologists who found the Challenge in 2008. Q-Ex has beforehand executed exploration and three way partnership agreements for different Peruvian exploration initiatives with Rio Tinto, Anglo American and Freeport-McMoRan.

Pursuant to the staged settlement outlined beneath, Solis Minerals has the correct to earn as much as a 75% curiosity within the issued share capital of a brand new three way partnership firm (“JVCo”) which is able to maintain 100% of the Challenge. Transaction milestones are summarised in Desk 3. Below the phrases of the settlement:

Signing: Solis Minerals pays an upfront signing / exclusivity price of USD$100,000 in money to supply 90 days of exclusivity to finish detailed due diligence.

Train: upon electing to proceed with the earn-in, the Firm pays an extra USD$300,000 in money upfront and difficulty A$1,000,000 in abnormal shares based mostly on a 30-day VWAP following completion of floor actions, leading to a 20% fairness curiosity within the JVCo. These shares can be topic to a six-month escrow interval Solis Minerals has 12 months from the train fee to finish floor actions.

Drill permits: following the approval of all drilling permits, Solis Minerals pays USD$200,000 in money, sustaining its 20% fairness curiosity.

Drilling: upon completion of a 5,000-metre drilling program and a choice to proceed to the following exploration stage, Solis Minerals pays an extra USD$200,000 in money and difficulty A$2,000,000 in shares based mostly on a 30-day VWAP, rising its JVCo fairness to 51%. These shares can even be topic to a six-month escrow interval. Solis Minerals has 12 months from the receipt of permits to finish the drilling program.

Milestone 1: JORC and PEA: can be achieved when Solis Minerals reviews a JORC-compliant useful resource of not less than 40Mt at 0.3% copper (or 120,000 tonnes contained copper equal) and publishes a preliminary financial evaluation (PEA). Upon completion, Solis Minerals will difficulty A$1,500,000 in shares, rising its fairness to 60%. Solis Minerals has 18 months to finish this milestone, and Q-Ex retains discretion to obtain the proceeds in money or shares.

Milestone 2: PFS: can be achieved when Solis Minerals publishes a prefeasibility research (PFS) and completes an extra 10,000 metres of drilling. Upon completion, the Firm will difficulty A$3,000,000 in shares, rising its fairness to 75%. Solis Minerals has 18 months to finish this milestone, and Q-Ex retains discretion to obtain the proceeds in money or shares.

Moreover, if Q-Ex’s fairness curiosity falls beneath 10%, this curiosity can be transformed to a 2% web smelter return (NSR) royalty. The Firm has the choice to purchase again half (or 1%) of the two% NSR for US$5 million. Solis Minerals could buy 100% of the mission fairness for US$10 million at any cut-off date inside seven years of Signing. Q-Ex can be free-carried by Solis Minerals till achievement of Milestone 2, at which level the Firm will maintain a 75% curiosity within the Challenge.

Desk 3: Abstract of Cucho key transaction milestones and phrases

(USD$) SLM shares

(AUD$)8 SLM JVCo

fairness (complete) Signing (90-day exclusivity) 100,000 (upfront) – 0% Train 300,000 (upfront) 1,000,000 (as soon as full) 20% Drill permits 200,000 (upfront) – 20% Drilling 200,000 (as soon as full) 2,000,000 (as soon as full) 51% Milestone 1: JORC + PEA – 1,500,000 (as soon as full) 60% Milestone 2: PFS – 3,000,000 (as soon as full) 75% Different phrases Worth

NSR 2% NSR buy-back 1% for US$5M Fairness buy-out (100%) US$10M (7 years) Free carry Q-Ex (till Milestone 2)

11. Subsequent steps

The signing / exclusivity price has been paid from current money reserves. Shareholder approval can be searched for the problem of all shares in reference to every stage outlined above. Every stage of the earn- in will solely be progressed on the idea that due diligence helps a powerful chance of future worth era.

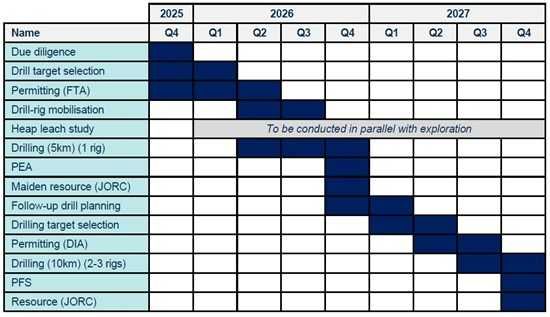

A staged strategy for due diligence and earn-in is designed to de-risk Cucho, with technical milestones and funding thresholds at every stage. Milestones and timelines have been established to make sure a disciplined, value-driven strategy to mission development:

2025: Due Diligence

The primary section will deal with finishing a complete due diligence evaluate of the Cucho Copper Challenge. Over a 90-day interval, Solis Minerals will conduct detailed technical, authorized, and business assessments to substantiate the Challenge’s potential and determine dangers; most of which has already been accomplished. Concurrently, planning will start for the preliminary exploration program together with development of drilling permits. Solis Minerals intends to finish detailed floor mapping and a drone survey to enhance 2026 drill goal setting.

2026: Floor Work and Allowing

Following profitable due diligence, the following steps will contain refining drill targets for a deliberate 5,000- metre drilling program. Throughout this era, Solis Minerals will proceed the method for acquiring vital drilling permits.

2026: First Spherical Drilling

As soon as permits are secured, the Firm will execute a 5,000-metre drilling marketing campaign concentrating on high- precedence, untested anomalies throughout the Challenge space. The outcomes of this drilling can be evaluated to find out the potential for copper sources and to tell choices concerning additional Challenge development.

2026/2027: Useful resource Definition and Preliminary Research

With the completion of first spherical drilling, Solis Minerals will compile and analyse the brand new knowledge with the purpose of creating a maiden JORC-compliant useful resource estimate. This can be accompanied by the discharge of a PEA, offering the market with an preliminary view of the Challenge’s scale and financial potential.

2027: Second Spherical Drilling and Prefeasibility Research

The ultimate deliberate stage will see an extra 10,000 metres of drilling to broaden the useful resource base and assist extra superior technical research. This section will culminate within the completion and launch of a PFS.

8 Milestones 1 & 2 are payable in money (A$) or shares on the Vendor’s discretion

Desk 4: Cucho Copper Challenge indicative exploration calendar.

To view an enhanced model of this graphic, please go to:

https://photographs.newsfilecorp.com/information/1134/271240_table.jpg

The schedule in Desk 4 is an announcement of present intentions as on the date of this announcement and relies on well timed allowing approvals, financing and profitable exploration at every stage. Solis Minerals’ current workforce – encompassing exploration, allowing, HSE and group relations – can be leveraged to speed up improvement of the Cucho Copper Challenge.

Registration of Solis Minerals as an Australian firm

As introduced on 16 September 2025, Solis Minerals acquired shareholder approval at its Annual Normal Assembly to undertake a continuance of its operations out of the Province of British Columbia and into Australia. The continuance is predicted to finish in November or December 2025. Solis Minerals confirms that the Cucho transaction doesn’t fall inside Part 14 of ASX Steerage Be aware 35, nor does it represent a cloth change in Solis Minerals’ circumstances that will render invalid the proposed continuance decision.

12. Portfolio concerns

Cucho is a superb complement to Solis Minerals’ current portfolio and one other key lever towards the Firm’s goal to Uncover copper-gold sources that may host large-scale mining in one of many world’s main copper-gold areas. Concurrent drilling on the flagship Ilo Este mission (100% Solis Minerals) and deliberate drilling on the extremely potential Cinto mission (100% Solis Minerals) present a wonderful pipeline of stories circulate and alternatives for shareholders.

Extra initiatives, together with Canyon and Chocolate, and some other worth accretive inorganic alternatives, place Solis Minerals as a wonderful incubator for large-scale copper-gold publicity in South America.

ENDS

About Solis Minerals Restricted

Solis Minerals is an rising exploration firm, targeted on unlocking the potential of its South American copper portfolio. The Firm is led by a highly-credentialled and confirmed workforce with wonderful expertise throughout the mining lifecycle in South America. Solis is actively contemplating a spread of copper alternatives. South America is a key participant within the world export marketplace for copper and Solis, below its management workforce, is strategically positioned to capitalise on progress alternatives inside this mineral-rich area.

Ahead-Wanting Statements

This information launch incorporates sure forward-looking statements that relate to future occasions or efficiency and replicate administration’s present expectations and assumptions. Such forward-looking statements replicate administration’s present beliefs and are based mostly on assumptions made and knowledge at present accessible to the Firm. Readers are cautioned that these forward-looking statements are neither guarantees nor ensures and are topic to dangers and uncertainties which will trigger future outcomes to vary materially from these anticipated, together with, however not restricted to, market situations, availability of financing, precise outcomes of the Firm’s exploration and different actions, environmental dangers, future steel costs, working dangers, accidents, labour points, delays in acquiring governmental approvals and permits, and different dangers within the mining trade. All of the forward-looking statements made on this information launch are certified by these cautionary statements and people in our steady disclosure filings. These forward-looking statements are made as of the date hereof, and the Firm doesn’t assume any obligation to replace or revise them to replicate new occasions or circumstances save as required by relevant legislation.

Certified Individual Assertion

The technical info on this information launch was reviewed by Dr. Paul Pearson, a Fellow of the Australian institute of Mining and Metallurgy (AusIMM), a professional individual as outlined by Nationwide Instrument 43-101 (NI 43-101). Paul Pearson is the Head of Exploration of the Firm.

Competent Individual Assertion

The data on this ASX launch regarding Geological Info and Exploration Outcomes is predicated on and pretty represents info compiled by Paul Pearson, a Competent One who is a Fellow of the Australasian Institute of Mining and Metallurgy. Paul Pearson is Head of Exploration of Solis Minerals Ltd. and has adequate expertise which is related to the model of mineralisation and kinds of deposit into account and to the exploration actions undertaken to qualify as a Competent Individual as outlined within the 2012 Version of the “Australian Code for Reporting of Mineral Assets and Ore Reserves”. Paul Pearson consents to the inclusion on this report of the issues based mostly on info within the type and context wherein it seems. Paul Pearson has supplied his prior written consent concerning the shape and context wherein the Geological Info and Exploration Outcomes and supporting info are introduced on this Announcement.

Disclaimer Relating to Historic Outcomes

Some historic outcomes have been reported below NI 43-101 and should not JORC-compliant. A Competent Individual has not accomplished adequate work to categorise these outcomes below the JORC Code. These outcomes are thought of indicative and haven’t been independently validated.

APPENDIX 1: CASE STUDIES

Case research – Cerro Verde mine, Peru (Freeport McMoran 53.5% (operator), Sumitomo Steel Mining 21% and Peruvian buyers 25.5%)

The Cerro Verde mine, situated about 30 – 35 kilometres southwest of Arequipa, is one in all Peru’s largest and most vital copper operations (Determine 10). It’s a huge open-pit porphyry copper- molybdenum deposit, first exploited for oxide copper early within the twentieth century and later expanded right into a world-class sulphide operation. The mine is operated by a three way partnership led by Freeport-McMoRan (53.5%), with Sumitomo Steel Mining and Peruvian buyers additionally holding vital stakes. A serious growth accomplished in 2015 remodeled Cerro Verde into one of many world’s largest concentrator- based mostly copper operations.

Cerro Verde’s orebody incorporates an estimated 4.6 billion tonnes grading roughly 0.35% copper, 0.1% molybdenum and 1.52 g/t silver9. Whereas these grades are low in contrast with many different copper deposits, the mission stays extremely aggressive on the worldwide value curve. Life-of-mine web site web money prices have been estimated at US$2.23 per pound. These figures replicate economies of scale, environment friendly mining, and vital by-product contributions from molybdenum and silver.

The mine operates with a twin processing flowsheet that mixes each leaching and focus. Traditionally, oxide and secondary sulphide ore have been handled by heap leaching adopted by SX/EW, producing as much as 200 million kilos of cathode copper per yr. Whereas a few of these leach services are being dismantled because the open pit expands, Cerro Verde nonetheless maintains a big run-of-mine leach operation. The majority of copper manufacturing, nonetheless, comes from its typical crush-grind-flotation concentrator, which after successive expansions now processes over 400,000 tonnes per day of ore. The plant additionally features a molybdenum circuit, producing vital by-product credit that additional cut back prices.

Cerro Verde’s success lies within the mixture of scale, infrastructure, and by-product income. Its huge concentrator ensures low unit prices regardless of low grades, whereas entry to energy and logistics close to Arequipa assist environment friendly operations. By-product molybdenum, gold, and silver gross sales considerably offset web site prices, pushing Cerro Verde constantly into the decrease half of the worldwide copper value curve. Like Constancia, it demonstrates how low-grade copper deposits in Peru could be become world-class, long-life producers by strategic funding in scale and processing effectivity.

Determine 10: Cerro Verde copper operation in Peru. This Case Research has been supplied for illustrative functions. Comparisons with different initiatives or mines, together with these which might be in manufacturing or at a extra superior stage of improvement, should not meant to suggest that the Firm will obtain comparable outcomes, recoveries, or financial outcomes. The potential amount and grade of any useful resource at Cucho is conceptual in nature, and there was inadequate exploration to estimate a Mineral Useful resource. It’s unsure if additional exploration will outcome within the estimation of a Mineral Useful resource. Buyers mustn’t place undue reliance on such comparisons.

To view an enhanced model of this graphic, please go to:

https://photographs.newsfilecorp.com/information/1134/271240_figure10.jpg

9 Freeport-McMoran, Technical Report 31 December 2024 (hyperlink: https://fcx.com/websites/fcx/information/paperwork/operations/TRS-CerroVerde.pdf)

APPENDIX 2: CUCHO COPPER PROJECT HISTORICAL DRILL RESULTS

(levels) Inclin

(levels) Depth Whole

(m) 1 COP14-01 222597 8845965 1475 0 -60 281.7 2 COP14-02 222778 8845887 1475 0 -60 316.55 3 COP14-03 222832 8846391 1575 340 -60 302.7 4 COP14-04 222832 8846391 1575 180 -60 268.5 5 COP14-05 222723 8846383 1590 210 -45 273.7 6 COP14-06 222848 8846050 1527 0 -60 246.1 7 COP14-07 222651 8846235 1556 210 -45 269.1

Coordinates, course, and depth of drill holes:

APPENDIX 3

JORC Code, 2012 Version – Desk 1

In circumstances the place ‘trade normal’ work has been accomplished this is able to be comparatively easy (e.g. ‘reverse circulation drilling was used to acquire 1 m samples from which 3 kg was pulverised to supply a30 g cost for hearth assay’). In different circumstances extra rationalization could also be required, akin to the place there may be coarse gold that has inherent sampling issues. Uncommon commodities or mineralisation sorts (e.g. submarine nodules) could warrant disclosure of detailed info. For floor geochemical sampling, in keeping with a 2014 Cucho Technical Report, ready below NI-43-101 requirements: “Bedrock samples have been taken from dug holes, trenches, some outcrops, and alongside profiles; 1810 samples of stream sediments, the channel, composite channel (as much as 8 kg), and level (4 kg) samples (together with 331 samples from trenches and dug holes) have been taken. 5 dug-hole traces, 20 trenches and strippings 648 m in complete size have been sunk and excavated. The dug holes are spaced at a distance of 20 m from each other alongside the road. The space between traces is 100-200 m. The purpose samples consisted of 20-30 chips collected from an space of 1-3 m2, as much as 4 kg in complete weight; composite channel samples have been 2-5 m lengthy, at least 30 chips, as much as 8 kg in complete weight; channel samples have been 1-2 m lengthy, at least 40 chips, as much as 6 kg in complete weight. Stream sediments have been taken from dry valleys; the burden of sieved materials (2 mm) was 0.5-1.0 kg; 231 samples have been taken past mineralized zones”. In keeping with a 2014 Cucho Technical Report, ready below NI-43-101 requirements concerning the drilling program: “The working diameter of HQ drilling and hardness of ore hosted in granodiorite ensured fixed restoration of cores with calculated diameter (63.5 mm) and consultant part sampling. No particular management of selective griding of ore minerals by the use of drill core samples taken in each round-trip was carried out. This process was changed with systematic measurement of core diameter by calipers in all holes with a step of fifty m.

Drilling approach s Drill kind (e.g. core, reverse circulation, open-hole hammer, rotary air blast, auger, Bangka, sonic, and so on) and particulars (e.g. core diameter, triple or normal tube, depth of diamond tails, face- sampling bit or different kind, whether or not core is oriented and in that case, by what methodology, and so on). In keeping with a 2014 Cucho Technical Report, ready below NI-43-101 requirements: “Drilling was applied initially with two after which one Hydeocore 2000 drilling rig (Fig. 9.3) of Terranova Firm twenty-four hours a day, utilizing a HQ diamond crown bit 63.5 mm in diameter. In a single case, emergency NQ diameter 47.6 mm was utilized to the final 20 m in Gap 7.” “Afterward, the drill gap was plugged-back by a particular resolution. The polyurethane plug in type of a pipe with lid inserted into the outlet’s mouth. Additional, the mouth was concreted and inscription on concrete offers details about drill gap, company-customer, and date of drilling”

pattern restoration Technique of recording and assessing core and chip pattern recoveries and outcomes assessed. Measures taken to maximise pattern restoration and guarantee consultant nature of the samples. Whether or not a relationship exists between pattern restoration and grade and whether or not pattern bias could have occurred as a result of preferential loss/acquire of tremendous/coarse materials. In keeping with a 2014 Cucho Technical Report, ready below NI-43-101 requirements: “After drilling, cores have been put into plastic containers (three meters per field), marked, and delivered into the core-classifying workshop. Having mounted info on drilling spherical journey, field quantity, and precise core restoration, the cores have been rigorously washed, photographed, and described” Logging Whether or not core and chip samples have been geologically and geotechnically logged to a stage of element to assist applicable Mineral Useful resource estimation, mining research and metallurgical research. Whether or not logging is qualitative or quantitative in nature. Core (or costean, channel, and so on) images. The overall size and proportion of the related intersections logged. Though an in depth description of geological logging has not been supplied, logging and core dealing with procedures seem like topic to plain trade follow. In keeping with In keeping with a 2014 Cucho Technical Report, ready below NI-43-101 requirements: “The sector knowledge have been processed within the camp in parallel with drilling. The pc database was compiled in EXCEL, after which columns of drill holes have been created in STRATER 4 program. A folder for every drill gap contained the next paperwork: database for the drill gap; log of sampling with theoretical and precise weights of core samples; core photographs; column of drill gap in program Strater 4; knowledge of directional survey; stock of core containers; Analytical knowledge on samples taken from this drill gap.” Sub- sampling methods and pattern preparation If core, whether or not reduce or sawn and whether or not quarter, half or all core taken. If non-core, whether or not riffled, tube sampled, rotary cut up, and so on and whether or not sampled moist or dry. For all pattern sorts, the character, high quality and appropriateness of the pattern preparation approach. High quality management procedures adopted for all sub-sampling phases to maximise representativity of samples. Measures taken to make sure that the sampling is consultant of the in-situ materials collected, together with as an illustration outcomes for discipline duplicate/second-half sampling. Whether or not pattern sizes are applicable to the grain dimension of the fabric being sampled. In keeping with In keeping with a 2014 Cucho Technical Report, ready below NI-43-101 requirements: “The sampling was steady, together with free sediments, all through the column of the drill gap. The size of sections (abnormal samples) assorted from 0.5 to 2.0 m (1.8 m, on common) was decided by inside construction and composition of ore-bearing and wall-rocks and by diploma of mineralization homogeneity. These options have been established visually in the midst of core documentation. In complete, 1958.35 m of cores have been documented and 1113 core samples have been taken in complete. Cores 63.5 mm in diameter have been an preliminary materials for abnormal samples, aside from the final 20 m in COP 14-07 Gap drilled by diameter of 47.6 mm. Half of core column sawed alongside its lengthy axis was delivered into the pattern bag. On the imply density of rocks all through the prospect (2.66 g/cm3), an approximate weight of pattern materials varies from 2.0 to eight.4 kg. In a while, samples are packed in plastic luggage and delivered to the Inspectorate Providers Peru S.A.C. Laboratory for comminution and analytical procedures.”

High quality of assay knowledge and laboratory exams The character, high quality and appropriateness of the assaying and laboratory procedures used and whether or not the approach is taken into account partial or complete. For geophysical instruments, spectrometers, handheld XRF devices, and so on, the parameters utilized in figuring out the evaluation together with instrument make and mannequin, studying occasions, calibrations elements utilized and their derivation, and so on. In keeping with a 2014 Cucho Technical Report, ready below NI-43-101 requirements: “All samples taken in the midst of drilling have been analyzed on the licensed laboratory of Inspectorate Providers Peru S.A.C. in July- September 2014. The samples have been ready following PRP70-250 circulate sheet (Fig. 10.1) and analyzed with ICP-OES (44 components), AAS for Cu and Mo, and hearth assay (30 g) with ASS ending for Au”

Nature of high quality management procedures adopted (e.g. requirements, blanks, duplicates, exterior laboratory checks) and whether or not acceptable ranges of accuracy (i.e. lack of bias) and precision have been established. In keeping with a 2014 Cucho Technical Report, ready below NI-43-101 requirements: “In accordance with QA/QC procedures, the standard management of sampling was applied in the midst of drilling. This management was carried out as follows: 1. 9 abnormal samples; 2. 1 normal pattern; 3. 9 abnormal samples; 4. 1 clean pattern; 5. 9 abnormal samples; 6. 1 duplicate pattern (1 / 4 of core) of the final abnormal pattern (1 / 4 of core).” “The convergence of the outcomes obtained on the fundamental Inspectorate laboratory and the controlling ALS for clean samples is sweet. The management outcomes are additionally above the utmost permissible error by 5 occasions. This suggests that the work of the essential Inspectorate laboratory doesn’t rouse censure and that overestimation of Cu contents in clean samples doesn’t happen.”

Verification of

Sampling and assaying The verification of serious intersections by both impartial or various firm personnel. The usage of twinned holes. Documentation of major knowledge, knowledge entry procedures, knowledge verification, knowledge storage (bodily and digital) protocols. Talk about any adjustment to assay knowledge. No impartial verification of outcomes is documented Location of knowledge factors Accuracy and high quality of surveys used to find drill holes (collar and down-hole surveys), trenches, mine workings and different places utilized in Mineral Useful resource estimation. Specification of the grid system used. High quality and adequacy of topographic management. In keeping with a 2014 Cucho Technical Report, ready below NI-43-101 requirements: “Localization of drill holes on the spot and topographic tie-in of them was carried out utilizing a Garmin 60CSx satellite tv for pc navigator in projected coordinate system WGS 1984 UTM, Zone 18S.” The Firm has independently discipline verified the place of numerous drillhole collars and located their positional accuracy to be enough. In keeping with a 2014 Cucho Technical Report, ready below NI-43-101 requirements: “With the intention to monitor gap deviation, the inclinometric logging was carried out utilizing a Reflex EZ-Trac equipment, a magnetic system for multipoint and orienting survey on the idea of magnetic and gravimetric sensors, which guarantee right measurements of azimuth deviations and zenith angles in any medium. The outcomes have proven that azimuth and zenith deviations are insignificant and don’t exert affect on the persistence of the accepted community of evaluative observations.”

Information

spacing and distribution Information spacing for reporting of Exploration Outcomes. Whether or not the information spacing and distribution is adequate to ascertain the diploma of geological and grade continuity applicable for the Mineral Useful resource and Ore Reserve estimation process(s) and classifications utilized

In keeping with a 2014 Cucho Technical Report ready below NI-43-101 requirements: “The limitation of drilling depth was attributable to technical causes and particular geological setting. In basic, a depth interval right down to 280 m has been penetrated. The overall meterage of seven drilled holes is 1958.35 m”

Whether or not pattern compositing has been utilized. In keeping with a 2014 Cucho Technical Report, ready below NI-43-101 requirements: “A distance between the drilling traces is diminished from 200 m within the south to 100 m within the north. A distance between drill gap collars alongside the road varies from 150 to 250 m. Due to the restricted meterage (2000 m), inclination of drill holes varies from 45o to 60o and their depths vary from 246.1 to 316.55 m. Such an association of drill holes ensures maximal intersections of the higher a part of stockwork and supplies perception into its inside construction.” Pattern compositing has not been utilized. Orientation of knowledge in relation to geological construction Whether or not the orientation of sampling achieves unbiased sampling of attainable constructions and the extent to which that is recognized, contemplating the deposit kind. If the connection between the drilling orientation and the orientation of key mineralised constructions is taken into account to have launched a sampling bias, this ought to be assessed and reported if materials.

No info on the connection between the drilling orientation and the orientation of key mineralised constructions is documented. Pattern safety The measures taken to make sure pattern safety. In keeping with a 2014 Cucho Technical Report ready below NI-43-101 requirements: “Cores have been transported by pickup truck, delivered to the core-classifying workshop for documentation and density measurement, then sawed, sampled, and transported to the bus station of the city of Barranca, from the place Paramonga Transport Firm handed them to the Inspectorate Providers Peru S.A.C. in Lima.” No particulars of measures taken to make sure pattern safety are documented. Audits

or critiques The outcomes of any audits or critiques of sampling methods and knowledge. No documentation is supplied as to any audits or critiques of sampling methods and knowledge.

Part 2 Reporting of Exploration Outcomes (Standards listed within the previous part additionally apply to this part)

and land

t enure standing Sort, reference identify/quantity, location and possession together with agreements or materials points with third events akin to joint ventures, partnerships, overriding royalties, native title pursuits, historic websites, wilderness or nationwide park and environmental settings. The safety of the tenure held on the time of reporting together with any recognized impediments to acquiring a licence to function within the space. The mission space is situated over the Choque Neighborhood, within the district of San Pedro, province of Ocros, division of Ancash. The mission space covers 7 mineral “concessiones”, Cayan 21, Cayan 23, Cayan 2, Cayan 22, Cayan 2105, Cayan 2109 and Cayan 2506 for an efficient space of three,600 ha, plus one underlying mining declare of 100 ha (La obra de Dios). “Two (02) mining concessions (Cayan 21 and Cayan 23) don’t overlap with some other mining concessions. Three (03) mining concessions (Cayan 2, Cayan 22, and Cayan 2105) partially overlap with two (02) mining concessions. Two (02) mining concessions (Cayan 2109 and Cayan 2506) partially overlap with one (01) mining concession. The Cayan 2 mining concession filed an preliminary request for an space of 500 ha, by Report No. 3567-2009-INGEMMET-DCM-UTN dated March 13, 2009. The world was diminished to 400 ha by Presidential Decision No. 1487-2009- INGEMMET/PCD/PM dated Might 26, 2009, granting the title to the Cayan 2 metallic mining concession to the mining firm QUIPPU EXPLORACIONES S.A.C. On December 5, 2023, a Switch Settlement was signed, with the holder, QUIPPU EXPLORACIONES S.A.C., transferring 100% of the shares and rights of the mining concession to ORE RESOURCES S.A.C., by Registry File (12499149). Equally, there may be one (01) mining petition in course of (Cayan 2506), which was filed on September 26, 2023, by the individual, Carlos Ernesto Belevan Sanchez. Two (02) mining concessions (Cayan 2105, Cayan 2109) within the space below session belong to the pure individual Carlos Ernesto Belevan Sanchez. Two (02) mining concessions (Cayan 21 and Cayan 22) within the space below session belong to the mining firm Quippu Exploraciones S.A.C. Two (02) mining concessions (Cayan 2 and Cayan 23) within the space below session belong to the mining firm ORE Assets S.A.C. The La Obra de Dios mining concession overlaps three (03) of the mining concessions with the next codes (010305222, 010158122, 010252822). Which belongs to the mining firm ORE RESOURCES S.A.C.”

Exploration accomplished by different events Acknowledgment and appraisal of exploration by different events. The mission was provided for finding out to Upstream Mining S.A.C. by Quippu Exploraciones S.A.C. in October 2008. Quippu had beforehand taken ~15 samples from bedrock outcrops, particles falls, and transported fragments with seen oxidized copper mineralization. A choice to advance the mission occurred in 2008 following inspection of copper oxide occurrences related to stockworks and quartz veinlet zones.

Detailed work in 2010-2011 included geological mapping at a number of scales, stream sediment and bedrock geochemical sampling, floor magnetics and radiometrics; and IP, magnetometry and resistivity surveys. Later floor rock sampling confirmed widespread anomalous copper and molybdenum, outlining a mineralised footprint of three x 1.8 kilometres. A scout diamond drilling program in 2014 comprised seven diamond drill holes for 1958.35 metres, designed to check near-surface oxide copper mineralisation. Geology Deposit kind, geological setting and elegance of mineralisation. Cucho is hosted throughout the Cretaceous to Palaeocene-age Coastal Batholith of Peru, U/Pb and Re-Os relationship confirms Cucho’s mineralisation at ~56 Ma, coincident with the age of Peru’s largest copper deposits. The Challenge hosts a alteration-mineralisation anomaly footprint of three x 1.8 kilometres. The anomaly is outlined by coincident copper- molybdenum geochemistry, floor mineralisation, and powerful peripheral induced polarisation (IP) chargeability anomalies. Mineralisation is hosted in batholithic granodiorite, with stockwork veining and copper oxide staining at floor throughout the surficial uncovered oxide zone, transitioning to major chalcopyrite-molybdenite sulphides at depth. A separate granitic porphyry physique intersected in drilling is interpreted because the potential supply of the broader mineralising system. Drill

gap Info A abstract of all info materials to the understanding of the exploration outcomes together with a tabulation of the next info for all Materials drill holes:easting and northing of the drill gap collar elevation or RL (Diminished Stage – elevation above sea stage in metres) of the drill gap collar dip and azimuth of the outlet gap size If the exclusion of this info is justified on the idea that the knowledge just isn’t Materials and this exclusion doesn’t detract from the understanding of the report, the Competent Individual ought to clearly clarify why that is the case. Info on the historic drilling program, together with collar positions, dip and azimuth of holes, gap lengths and so on. is hosted within the physique of the doc and in Appendix 2

Historic exploration knowledge solely is being reported that can be topic to due diligence and verification as a part of the Firm’s analysis course of. Additional work The character and scale of deliberate additional work (e.g. exams for lateral extensions or depth extensions or large-scale step-out drilling). Diagrams clearly highlighting the areas of attainable extensions, together with the principle geological interpretations and future drilling areas, supplied this info just isn’t commercially delicate. A staged strategy for due diligence is designed to de-risk the Challenge, with technical milestones and funding thresholds at every stage. Milestones and timelines have been established to make sure a disciplined, value-driven strategy to mission development: Due Diligence Floor work and allowing First spherical drilling (5,000 metres) Useful resource Definition and Preliminary Research Second spherical drilling (10,000 metres) and Pre-feasibility Research

To view the supply model of this press launch, please go to https://www.newsfilecorp.com/launch/271240