In accordance with the U.S. Treasury Division, an enormous promoting marketing campaign resulted in households signing up about 3 million kids to Trump’s accounts nicely earlier than the July launch date.

Maybe “free cash” might be an incredible incentive. The federal authorities introduced it can make a one-time contribution of $1,000 to the accounts of all eligible kids born on or after January 1, 2025, by December 31, 2028. A rising variety of corporations are pledging to match Treasury deposits for the youngsters of their workers, and philanthropists in a number of states have pledged to donate to the accounts of particular eligible households.

“The president referred to as on enterprise leaders and philanthropists throughout the nation to hitch us on this effort,” Treasury Secretary Scott Bessent stated Friday in a speech on the Dallas Financial Membership.

However past the preliminary deposit, many questions stay about how these accounts are managed and invested.

“There are extra unanswered questions than there are solutions at this level,” stated Mary Morris, CEO of Commonwealth Savers, the company that manages the nationwide Invest529 program. A 529 school financial savings plan is one other tax-advantaged funding possibility that permits households to save lots of on behalf of their kids.

“There’s a whole lot of great things on the market, however there’s nonetheless a whole lot of unknowns about the way it works,” Morris stated.

“The Trump Account will revolutionize wealth creation,” a Treasury Division spokesperson informed CNBC in an emailed assertion.

“As we strategy the opening of the fourth spherical of accounts in July, we may have additional attention-grabbing particulars and steerage from the Treasury,” the spokesperson wrote.

How is my account verified?

First, it is not completely clear how Trump’s account utility might be verified.

To arrange a Trump Account (also called a 530A account), a dad or mum or guardian should file IRS Kind 4547 with their 2025 tax return or through TrumpAccounts.gov. Subsequent is the “certification course of,” which is anticipated to start someday in Might. There aren’t any particulars but on what meaning, however the White Home says the federal seed cash is anticipated to reach on July 4.

How will the funds be invested?

Trump account considered on cell phone.

Offered by Trump Account

Trump’s account web site exhibits a mockup of an unreleased app interface that tracks returns for some shares. Nevertheless, in keeping with Treasury pointers, Mr. Trump’s account could be invested in “broad-based U.S. inventory index funds” resembling mutual funds and exchange-traded funds, relatively than particular person shares like Nvidia.

“This can be a sensible solution to make the most of some trending shares and promote shares, attempting to get extra bang on your buck,” stated Ben Henry Moreland, senior monetary planning geek at advisor platform Kitces.com. Precise funding choices haven’t been introduced.

Whereas the “100% inventory funding possibility” has its advantages, a latest Vanguard analysis paper notes that the Trump account “doesn’t incrementally cut back threat towards a hard and fast revenue allocation” like different account varieties, resembling a 529. These sometimes begin with extra fairness publicity early on and develop into extra conservative over time because the fundraising goal date approaches.

How will President Trump’s account have an effect on the inventory market?

When the U.S. inventory market opens on Monday, July 6, greater than 3.5 million accounts might be pre-funded with $1,000 grants for newborns based mostly roughly on the variety of infants born in a yr, probably kicking off the post-holiday buying and selling week, in keeping with CDC information.

If all of those accounts have been funded with a further $1,000 in employer matches and $500 in household contributions, there could be as a lot as $8.75 billion flowing into the market, stated Christopher Mistal, director of analysis at Inventory Merchants Almanac.

Nonetheless, that is only one.7% of the market’s common day by day exercise, far lower than the massive capital inflows ensuing from the Federal Reserve’s bond-buying program generally known as quantitative easing, Mistal informed CNBC.

“The share will decline additional as a consequence of fewer members, fewer funded accounts, or each,” he wrote in a follow-up electronic mail. He added that if this system have been rolled out over a number of buying and selling periods, the impression available on the market could be additional diminished.

“With massive numbers of members and cash, Trump’s account may have a modest however hard-to-measure bullish impression throughout an already traditionally bullish interval,” Mistal stated, referring to the everyday timing of the mid-year rally in July.

“Even when all the kids’s cash have been traded in a single commerce a day, it could nonetheless be a comparatively small proportion of the full market quantity for the day,” Matt Lira, co-founder of Make investments America, a nonprofit advocacy group that helps Trump’s accounts, stated in an interview on CNBC.

Make investments America additionally paid for Trump Accounts’ Tremendous Bowl commercials to advertise its new funding account for youngsters.

The place will the custodian monetary establishment be?

The Treasury Division says Trump’s account might be held by a “designated monetary agent,” whose id has not but been made public.

“For now, my important query is answered: Who might be in cost?” Henry Moreland stated.

Account managers could must preserve observe of the beneficiary foundation, the non-taxable portion of the account, and subsequent taxable earnings.

Moreover, Zach Teutsch, founder and managing companion of Values Added Monetary in Washington, D.C., beforehand informed CNBC that traders may have to contemplate storage charges that may cut back returns. Teutsch is a member of CNBC’s Monetary Advisory Council.

How will President Trump’s account have an effect on his annual tax return?

One other potential difficulty is present tax submitting necessities. Dad and mom, guardians, grandparents and others can donate as much as $5,000 a yr (after taxes) to Mr. Trump’s account, and specialists say they might should file a present tax return even when their whole present is lower than the annual deduction. The annual present exclusion quantity for 2026 is $19,000 per recipient.

To qualify for the annual exclusion, the present should be of “present curiosity” and instantly accessible to the recipient. Some monetary advisers have questioned whether or not presents to Mr. Trump’s accounts meet that commonplace, probably triggering present tax filings.

Make investments America’s Lira informed CNBC that the Treasury Division is “conscious of the problems” surrounding potential present tax filings. “They’re monitoring that difficulty very carefully,” he stated.

Lira stated the Treasury Division “will proceed to difficulty steerage on these points.”

What are the tax implications on withdrawals?

How distributions, together with contributions by mother and father, certified charities, and the federal government, might be taxed sooner or later is one other difficulty the IRS might want to make clear.

To make sure, traders in Trump accounts must plan for future taxes on withdrawals, specialists say.

“These accounts work like this [individual retirement accounts]” stated Marianela Corrado, CEO and authorized monetary planner at Tobias Monetary Advisors in Plantation, Florida. Pre-tax funds are topic to peculiar revenue taxes upon withdrawal, she stated.

Moreover, withdrawing funds earlier than age 59 1/2 may end in a ten% penalty, with some exceptions, stated Corrado, an authorized public accountant and member of CNBC’s Council of Monetary Advisors.

Calculating taxes on future withdrawals would require pre-tax and after-tax data of contributions to the Trump account, he stated.

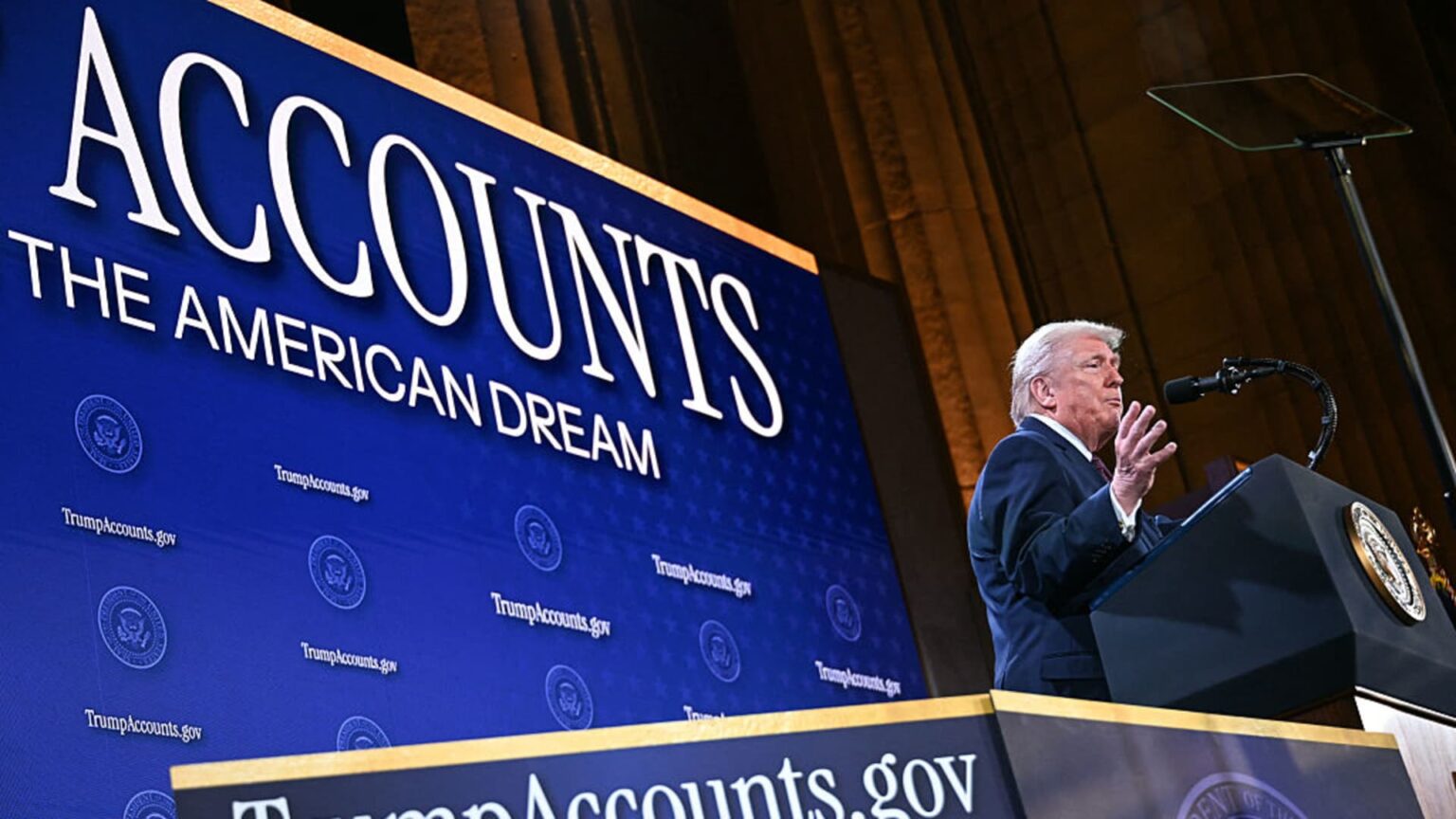

U.S. President Donald Trump speaks concerning the “Trump Account” on the Andrew W. Mellon Auditorium in Washington, DC, on January 28, 2026.

Brendan Smialowski AFP | Getty Pictures

Funds within the Trump account develop tax-deferred till withdrawn. There isn’t any upfront tax deduction for after-tax contributions, however earnings are topic to tax upon withdrawal. Then again, pre-tax contributions are excluded out of your revenue, however you’re liable to pay future taxes on the contributions and any future progress.

The breakdown is as follows:

Direct Mother or father Contributions — After-Tax Pilot Program $1,000 — Pre-Tax Employer Contributions — Pre-Tax Different Certified Contributions — Pre-Tax Future Contribution Will increase — Pre-Tax

Consultants say that for those who do not observe your after-tax funds, you would find yourself paying peculiar revenue taxes on all future withdrawals out of your Trump account.

Make investments America’s Lira informed CNBC that long-term monitoring of the supply of funds within the Trump account and future tax remedy is “clearly a priority for monetary establishments and one thing to contemplate.”

“Because of our conversations with these monetary establishments, we have now discovered that there are answers for monitoring info over the lifetime of an account,” he stated.

For now, monetary advisers usually advocate that households eligible for “free funds” open a Trump account and wait till all info is offered earlier than deciding whether or not so as to add further funds.