Palantir is the top-performing inventory of the S&P 500 for the second 12 months in a row, but it surely’s doable {that a} nasty promoting is popping the nook.

As of August twelfth closing bell, Knowledge Mining Darling Palantir Expertise shares (pltr -2.14%)) Up to now, it has skyrocketed by 147%. That is the very best efficiency on the two-year S&P 500.

The apparent subject right here is that Palantir is operating monsters in the middle of the Synthetic Intelligence (AI) revolution. Skeptics level to the high-praising scores of Palantia because the cornerstone of the bear debate, as shares commerce at ranges that invade shares within the territory of the bubble throughout the dot-com period. It is true, however such issues haven’t stopped the shares from repeatedly profitable new highs.

There are far more refined particulars surrounding Palantir inventory and I believe it is hardly ever mentioned. If historical past is a information, you may set a stage of epic reversal.

Is it time to promote Palantir inventory? Please learn to seek out out.

An analysis that redefines the that means of being “costly”

Within the late Nineteen Nineties, web corporations have been typically measured by non-financial metrics based mostly on consumer engagement. Amazon, Cisco, Microsoft, Alphabet, Yahoo! have been evaluated based mostly on eyeballs and clicks, not company gross sales or income. On the peak of Dot-com euphoria, many of those web pioneers traded at multiples of costs (P/S) of 30-40, however on the time it was considered inadequate.

Nonetheless, Palantir has fully redefine how the subsequent technology of know-how enterprise shall be valued. As of August twelfth, Palantir boasts a market capitalization of almost $444 billion. It is a far more mature and numerous enterprise than Salesforce, SAP and Adobe. Maybe much more spectacular is the presence of 137 PALANTIR P/S in its personal stratosphere.

PLTR PS ratio knowledge by YCHARTS

Some argue that conventional valuation methodologies corresponding to P/S and multiples of income don’t totally seize the true worth of Palantir or its full potential. As an alternative, they encourage traders to see how a lot “low-cost” parantile shares actually are, specializing in industry-specific, financially designed metrics, such because the 40 guidelines.

I believe this argument is flawed. There’s a extra outstanding metric – and what nearly nobody talks about involves assume Palantir inventory is on a collision course with historical past.

Picture supply: Getty Photographs.

Is “sensible cash” attempting to inform us something?

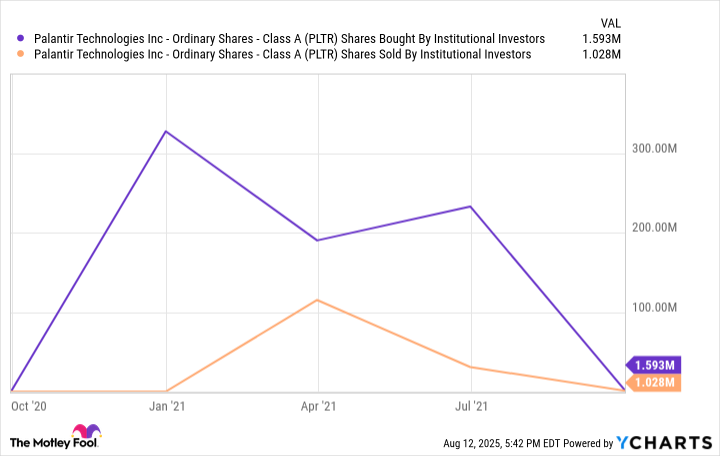

The chart beneath tracks Palantir inventory buy exercise throughout institutional traders for the reason that first public providing (IPO) in late 2020.

PLTR inventory bought by institutional investor knowledge by YCHARTS

Initially, there was a wave of “sensible cash” purchases in early 2021, however there was a substantial quantity of gross sales later that 12 months. Palantir’s institutional possession was as soon as once more taken up after the corporate jumped into the AI realm a couple of years in the past. It’s this dynamic that retail funding crowds miss out on larger photos and purchase them at Mirage.

Because the chart above reveals, convergence happens throughout institutional shopping for and promoting on Palantir inventory. Stronger web demand signifies that buys are just about not greater than gross sales, however there’s much less draw back strain to trigger a pointy drop in inventory costs. The dynamics proven within the chart above are seen as inflection factors within the Palantir inventory.

Moreover, banks, asset administration corporations, mutual funds and hedge funds all have completely different priorities. Many of those establishments want to carry giant caps for benchmark functions, not as a result of they imagine their shares are undervalued or as a result of they’re convicted of a “diamond hand” that their shares are excessive regardless of present extraordinary volatility. Institutional traders typically trim publicity when shares weigh terribly greater than their general portfolio. This is named portfolio rebalancing.

Tesla’s Ron Barron

“I am the final, I will be the final. I am going to not personally promote a single share till I promote all of the shares for my purchasers.– Tesla Proprietor Silicon Valley (@teslaownersSV) March 12, 2025

This state of affairs could be totally defined within the video clip above. On this state of affairs, mutual fund billionaire Rombaron explains his fiduciary accountability to reap the benefits of even the very best conviction positions, corresponding to Tesla. If the shares develop excessively, the establishment makes use of this market liquidity as a mechanism to promote the inventory at insurance coverage premiums. This dynamic colloquially refers to retailers “holding their baggage” when the hype story fades away.

I can not say for sure the place Palantir shares are heading, however in my view, fund traders will strain portfolio managers to trim publicity to Palantir and steal cash from the desk, identical to Baron has skilled. I believe the strain is rooted in anticipating a Palantir score reset, given its frothy positioning towards the peer.

Does historical past repeat itself?

Historical past will not be essentially an ideal predictor, however on this case I believe it is a robust barometer. Whereas it’s just about unimaginable to decide on the very best time to promote your stock, I believe there are some compelling and ignored particulars that counsel that Palantir shares may fall beneath present costs ahead of many bulls count on.

Adam Spatacco has positions in Alphabet, Amazon, Microsoft, Palantir Applied sciences, and Tesla. Motley Fools introduces and recommends Adobe, Alphabet, Amazon, Cisco Techniques, Cloudflare, Crowdstrike, Datadog, Microsoft, Mongodb, Palantir Applied sciences, Salesforce, ServiceNow, Snowflake, Tesla, and Zscaler. Motley Idiot recommends the next choices: A $395 cellphone at Microsoft for January 2026 size and a $405 cellphone to Microsoft for January 2026 quick time period. Motley Fools have a disclosure coverage.