McDonald’s (MCD) -0.85%)) It is likely one of the most profitable restaurant chains in historical past. What started as a Southern California burger restaurant has grown into a world chain with over 44,000 areas in over 100 nations.

Whereas such progress works nicely for long-term traders, it might probably result in uncertainty in future progress plans. This complicates the prospect of changing McDonald’s $10,000 shares to $50,000 over the following 5 years. Because of this.

Picture supply: Getty Photos.

Obtain 5 growths

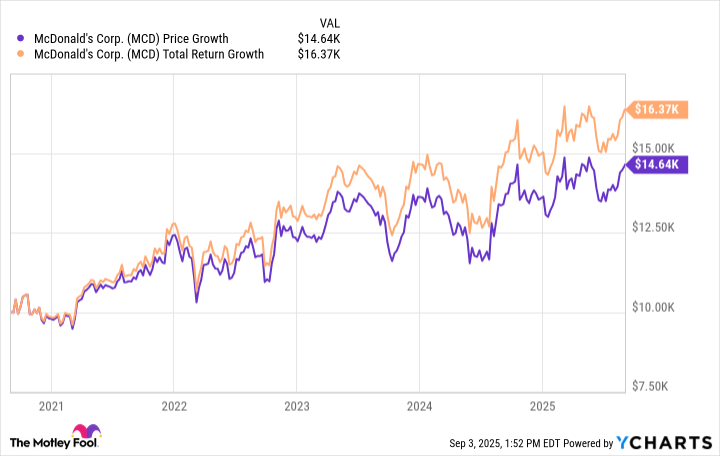

Sadly for the McDonald’s Stockbulls, its current historical past has not pointed to 5 instances the income in 5 years. If you happen to invested $10,000 5 years in the past, the place is value lower than $14,600 in the present day. If included dividend revenue, which has been rising yearly since 1976, it will increase to lower than $16,400.

MCD knowledge by YCHARTS.

This does not imply that McDonald’s is a poor alternative. Its enterprise mannequin is run as a franchise, with roughly 95% of the areas working as a franchise. After paying the franchise charge, the franchisee should hire the property from McDonald’s and pay a royalty charge equal to 4% or 5% of the gross sales. Mounted prices outline a big a part of this association, making the corporate’s enterprise mannequin extraordinarily recession-bearing.

However, its monetary progress could not stimulate 5 instances extra income over the following 5 years. Within the first six months of 2025, revenues elevated by just one% per 12 months, at $12.8 billion. Though it retains prices and bills up, its web revenue for the primary half of the 12 months was $4.1 billion, a revenue of simply 4% per 12 months.

Moreover, its 27 P/E ratio is barely beneath the S&P 500. (^gspc -0.32%)) Common 30. This can give shares a median score, lowering the possibilities of dramatically growing income multiples.

As an organization, McDonald’s ought to proceed to revenue from elevated income and dividends from franchisees. It ought to convey constructive advantages to the corporate, however its monetary progress is not going to flip its $10,000 funding into $50,000 over the following 5 years.

Wilkhealy has no place in any of the shares talked about. Motley’s fools don’t have any place in any of the shares talked about. Motley Fools have a disclosure coverage.